- 2021-05-31

- 阅读量:5384

- 来源|CBO

- 作者|Zhang Huiyuan

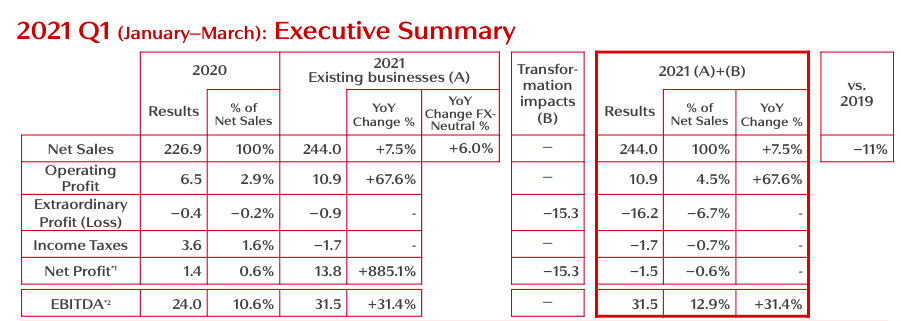

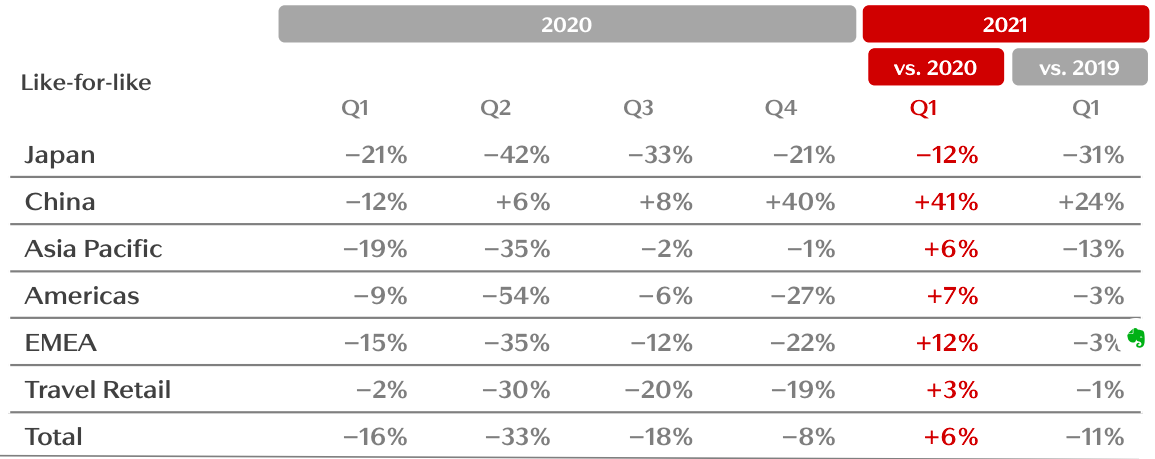

According to Shiseido Group's Q1 2021 Financial Statements sales/profits were recovering steadily in this quarter despite the COVID-19 epidemic. The Chinese market has been growing strongly for Shiseido, and it has been a leader of Shiseido's overseas markets outside of Japan for years.

01

With a dramatic increase of 41.1% in sales in Q1 2021, will China overtake Japan to become Shiseido’s largest market in the world?

In 2020 the COVID-19 epidemic dealt a heavy blow to Shiseido Group's business in China. In 2021 however, thanks to the effective control of the Chinese government, the economy and society was basically put back on the right track. In the reporting period, sales volume in Q1 2021 even increased by 20% year over year compared with that in 2019, a year which saw business growing by leaps and bounds.

41.1% - the growth rate that Shiseido Group delivered in China in Q1 2021 (with sales volume based on local currency). After conversion into Japanese yen, its sales volume in China hit 65.3 billion yen (about RMB 3.86 billion), an increase of 46.8% compared with that in the same period in 2020, making China its largest overseas market for years.

02

Cope with Market Changes through Comprehensive Digital Transformation

According to its medium and long term development strategy "WIN 2023 and Beyond", Shiseido will focus its core business on skin care and promote its business reform in depth. The key to achieving this goal is the "transformation and structural reform towards the digital business model".

On May 11 Shiseido announced that the company had reached an agreement with Accenture Co., Ltd. on setting up a joint venture company, Shiseido Interactive Beauty Co., Ltd. ("Shiseido Interactive Beauty"), in July this year with a view to providing digital marketing business and digital/IT-related business for Shiseido and its group companies to accelerate the digital transformation and quickly respond to the ever-changing market environment and customer needs. As early as February 2021, Shiseido and Accenture reached a consensus on establishing a strategic partnership.

For example, new beauty experience, which could not be provided in the past by Shiseido alone, will be available at the new company. By storing in the database the historical data of skin diagnosis and virtual makeup try ons carried out by customers online and in brick and mortar stores, and by comparing historical data with purchase, research and development data, the new company can introduce the most suitable consulting services, products and course menus for customers to choose at their discretion.

With the latest beauty technology, the new company will be able to seamlessly provide tailor made services to consumers.

At the same time, Shiseido will launch the "Cloud First" initiative to migrate its existing systems to the cloud. By expanding IT functions and establishing flexible system infrastructure, the company will be able to improve its efficiency in making IT investment and maintaining costs, getting business done faster and making quicker decisions based on data.

In addition, by using Accenture's expertise in human resources development Shiseido will jointly develop and provide special projects for digital and IT human resources where the company hopes to strengthen its capabilities, and cultivate employees with advanced skills in digital and IT fields. At the same time, the company will absorb more talent to improve its overall capabilities in the fields of digitalization and IT.