- 2022-01-11

- 阅读量:3074

- 来源| Cosmetic Business Online

- 作者|

In the new and increasingly competitive beauty and personal care market, foreign brands seem to have passed the period of easy dividends, and are entering a highly competitive environment. Consumers’ needs are becoming diversified. Foreign brands are also thinking about what else they can provide for consumers in addition to the glory of “imported brands".

33 years ago P&G decided to enter China - a completely unfamiliar market.

Berenike Ullmann, the employee No. 001, a Swiss who majored in Chinese and Chinese literature, was sent to China to do only one thing: "market research".

She visited consumers in Chinese cities and towns in the late 1980s, and finally brought back a message to P&G Cincinnati Headquarters that most Chinese people were washing their hair with soap and washing powder, but they can’t solve the problem of dandruff.

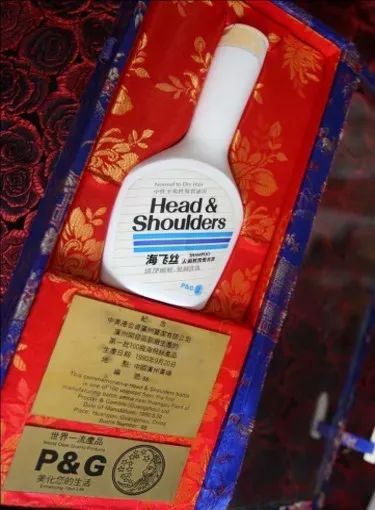

\In 1988 P&G successfully entered China, the world's second largest cosmetics consumer market eventually, with its first new product in China - Head & Shoulders Anti-Dandruff Shampoo.

Over 40 years of reform and opening up, Chinese people’s demand for beauty care , ranging from hair to skin care and from anti-dandruff to whitening, has been exploding. The businesses all over the world wish to come across the ocean to sell products to Chinese consumers in the areas of hair care, skin care, facial care, laundry, etc.

01

"New Products"

In recent years, many large global groups and new overseas brands have taken Tmall Global as the first stop for entering China and incubating "new products".

In the past year, the number of overseas brands settled in Tmall Global have shown a three-digit growth. Take Tmall Global's personal care and household cleaning sector as an example. This year, Tmall Global has introduced more than 200 new oversea brands to Chinese consumers, mainly from Europe, the United States, Japan, South Korea, Thailand and other countries.

The mainstream consumers of cross-border online shopping are getting younger and younger. On Tmall Global, the number of post-2000s generation consumers of cross-board online shopping has increased by nearly 70% year-on-year, with the fastest growth rate. The number of post-1990s and post-1995s generation consumers accounts for nearly 50%.

When it comes to "Gen-Z" consumers, all brand owners know that they are self-centered and accustomed to "making themselves happy". They are particularly fickle and will not be blindly loyal to any top brand.

"Chinese consumers have very high standards and requirements for the beauty and hair care products they want. They are individually experts who will do research and try out different products, so more refined products can truly meet their needs." Linda, the Brand Director of Paris L’Oréal PRO, believes that it is becoming more and more difficult to retain consumers.

"Chinese consumers may be one of the pickiest consumers in the world." Kanye Wu, President of P&G's cross-border business in Greater China, also feels the same.

Under the accelerated competition, brands are facing increasing pressure , and motivation from the pressure, they are accelerating in innovation.

Brand owners are accelerating the launch of new products in the Chinese market.

From the perspective of Tmall Global’s personal care and household cleaning sector, the nearly 10,000 new products launched in the past year concentrated on advanced and upgraded categories that represent new trends in imported consumption, such as scalp care, hair dye cream, fun bathing, home fragrance, high-luxury washing and care, hair loss prevention and growth, and high-end fabric care categories.

Do these new products really meet the needs of the Chinese market? Will consumers buy it?

Canesten Hygiene Laundry Rinse under Bayer is Australia's No. 1 disinfectant. It entered China at the end of 2019 and has worked its way to become the No. 1 disinfectant brand on Tmall Global within two years.

"Its core selling feature is that it can remove not only bacteria, but also 99.99% of fungi." said Wan Yanjing, Vice President of Bayer Asia Pacific Cross-border E-commerce and China Domestic E-commerce.

"If you want to ask Chinese consumers why there is essential demand for anti-fungal categories, it is actually because people's hygiene habits have fundamentally improved in the post-pandemic era."

02

"Customization"

Just as P&G conducted "market research" before entering the Chinese market, it is necessary to conduct "survey" on target consumers and discover their "essential demand" to ensure the success of products.

In addition to relying on third-party consulting companies, using basic data and observing pandemic chatter, brands have another helpful assistant-Tmall Global. Through the platform's market and consumer insights brands can better understand the Chinese market and make brand decisions that are well targeted and evidence based.

"Now it is time for elaboration. If you don't find the real pain points, you will not be able to find real market opportunities." Wan Yanjing said, "Tmall Global has given us a more complete understanding of the market.”.

To accelerate the exchanges between the demand side and the supply side, Tmall Global provides consumer insights to brands and helps brands to discover consumers’ refined needs to develop “tailored” products for consumers.

Since 2021, overseas brands and Tmall Global's personal care and household cleaning sector have jointly created nearly 10,000 new cross-border products.

"Chinese consumers do not like the strong flavor that foreign consumers prefer, but they prefer the scents of flowers, fruits, and tea. In view of this, in the first year of listing, Marvis has developed a 'tea flavor' product that is more acceptable to Chinese and Asian consumers." said Li Shan, Head of the Marvis China Market and General Manager of PShanghai PROFEX.

Marvis is a French oral care brand, known as the "Hermes in toothpaste". In fact, Marvis already has more than 50% of its R&D funds dedicated to developing new products for Chinese consumers.

As an anti-dandruff wash and care brand of Sanofi, a world-renowned pharmaceutical company, Selsun has reduced the development period from more than 12 months required for conventional pharmaceutical companies to 6 months in order to solve Chinese consumers' pain points of dry hair after using anti-dandruff products. In May 2020, a new product, Selsun Green, was launched on Tmall Global. This new product helped Selsun to enter the single-brand RMB 100 million club in one year.

In addition to cleaning products, there is a large market space for head care products. According to the data from Tmall Global, in the past year, "hair care essence oil ampoule" and "scalp care" were the fastest growing categories in the personal care and household cleaning sectors on the platform, with growth rates of 287% and 95%, respectively.

Large group brands such as L'Oréal are working hard on scalp care and other trendy areas and investing in new product research and development.

03

Supply Chain Reform

How each new product can be quickly introduced to the market and accurately reach consumers in the shortest time and at the lowest cost, after it leaves the production line, is the ultimate goal pursued by major brands and manufacturers.

"On the one hand, cross-border retail imports greatly shorten some import procedures and costs compared to general trade. Cross-border retail import channels can provide a good testing channel for overseas products that have not entered China, which reduce the trial and error cost of overseas products entering China. The cross-border retail import channels also helps the brands to communicate with Chinese consumers in a timely manner." commented Yu Zhou, head of Cross-border E-commerce Department of Hangzhou Comprehensive Free Trade Zone.

To help brands greatly shorten the entire response speed and improve the efficiency of the entire cross-border supply chain, since 2020 Tmall Global has also continued to promote the China pioneered “bonded import + retail processing” new world factory model. This new world factory model allows overseas businesses to open their factories in China domestic bonded areas, transforming the process of mature cross-border retail import supply chain, conducting terminal processing and sub-packaging of overseas finished products at domestic bonded areas. Thus it provides merchants with the ultimate supply chain services and flexibility in customizing products for Chinese consumers.

△Tmall Global's Bonded Warehouse

"We, together with Tmall Global, created and integrated the 'timely delivery' services. Originally, for many cross-border products we could only choose the existing bonded model. We also try to achieve the goal that products can reach consumers within 2-3 days." Said Xu Lei, Director of E-commerce of Sanofi Health Pharmaceuticals.

Blockbuster new products are a kind of scarce resource, and the process of being created is full of persistence and game theory. Behind the huge cost, in fact, more and more imported brands regard the Chinese market as the "core market".

Today, Bayer's investment in the Chinese market far exceeds the global average.

"In fact, we strategically gave up the sales of Australia, the country of origin, to support the strong growth of the Chinese market, and we did not hesitate to pay high freight charges for this". Because they are optimistic about the development of the Chinese market in the next few decades, when international shipping encounters huge challenges under the pandemic, they made a decision that no one could consider believable 10 years earlier.

”Sanofi's headquarters attaches more importance to the Chinese market year by year, because it firmly believes that "China will become Selsun's largest market in the world in 2022".

In the 7 years since its inception, Tmall Global has built a "fast lane" for countless global brands to enter China.

From a larger perspective, "the Chinese market is becoming the world's market". Tmall Global will use the power of ecosystem to link buyers and sellers, and continue to play the role of a cross-border e-commerce platform to help outstanding brands around the world enjoy together China's huge market.

Recently, Tmall Global released a commercial documentary "Global New Products for China". The documentary revealed what efforts P&G, L'Oreal, Sanofi, Bayer and other group merchants and Marvis, Olaplex and other new brands have made to satisfy the increasingly demanding Chinese consumers.