- 2021-11-18

- 阅读量:2442

- 来源| Cosmetic Business Online

- 作者|Li Jianzi

During the Nov. 11 Online Shopping Festival ("Double 11"), beauty products are still hot sales and domestic brands are ushering in a new period of growth.

As Double 11 enters its thirteenth year, how has the ultimate annual "warfare " of the beauty category evolved?

01

Tmall and JD.com saw turnover in short time

higher than last year’s all day turnover

With the official opening of the "2021 Tmall Double 11 Global Carnival Season" on the evening of October 21, the accumulated pre-sale effective amount of the beauty industry within the first 21 minutes of pre-sale was higher than that of the first 12 hours of pre-sale last year. The beauty industry recorded pre-sales of RMB10 billion in the first 45 minutes of the pre-sale. In the first hour of presale there were 30 merchants with presale amounts over RMB 100 million, and there were also 16 single products with presale amounts over RMB 100 million.

The effective pre-sale amount on Tmall in the first two hours of pre-sale surpassed that of the first day of pre-sale last year. During the first four hours of pe-sale, there were 2 stores each with pre-sale amount of RMB1 billion, 43 merchants with pre-sale amounts of RMB 100 million, and 30 single products with pre-sale amounts of RMB 100 million.

Data shows that JD Beauty had a good start in the opening day of Double 11. In the first 10 minutes, 40 brands recorded YoY pre-sales growth of 100%. In the first 30 minutes, the overall beauty category recorded YoY pre-sales growth of 50%. The turnover amount in the first 4 hours exceeded that in the whole opening day of Double 11 last year. Specifically, single products such as gift sets, facial essences, and eye creams showed particularly outstanding performance. Within 40 minutes high-end beauty products recorded more pre-sales than during the whole opening day of last year. A number of major beauty brands ushered in explosive growth, including more than 50 well-known brands such as Estee Lauder, Lancome, Helena, SK-II, Kiehl's, Clinique, Sephora. SK-II Fairy Water, Estee Lauder Small Brown Bottle Eye Cream, L'Oreal Retinol Toner and Lotion Set became absolute hot-sale products.

In addition to exquisite skin care category, the make-up category also ushered in explosive growth on the JD platform. According to the data from JD.com, make-ups such as lipstick, makeup remover, and perfume were hot sales. The make-up remover category, perfume category and lipstick category recorded YoY pre-sales growth of nearly 3 times, 2 times, and 144%, respectively.

02

TOP ranking list is still a contest among foreign giants

From the perspective of ranking, Double 11 is still a contest among foreign giants.

According to the pre-sales data from JD.com, high-end beauty products recorded YoY pre-sales growth of 176%, and 50 top high-end brands including Estee Lauder, Helena, Clinique, Guerlain, and MAKE UP FOR EVER recorded YoY pre-sales growth of more than 100%. Among them, Estee Lauder, Guerlain and Helena were the most popular among consumers.

In terms of single product, L'Oreal Revitalift Retinol Anti-Wrinkle Toner and Lotion was popular among consumers, with YoY pre-sales growth of more than 10 times. SK-II Big Red Bottle Cream (100g, classic version) and the popular SK-II Fairy Water recorded YoY pre-sales growth of 380% and nearly 3 times, respectively.

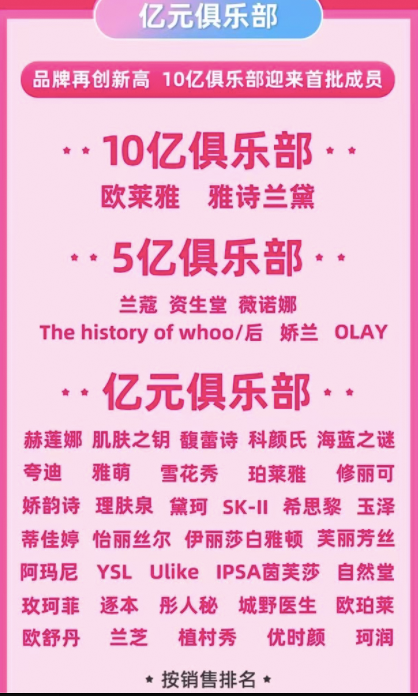

On Tmall, the "RMB1 billion club" ushered in the first batch of members. L'Oréal's pre-sales amount exceeded RMB 1 billion after 1 hour and 45 minutes, and this was more than whole day of last year. The Estée Lauder Tmall Flagship Store became the first to achieve pre-sales of over RMB1 billion among the high-end beauty brands.

In addition, members of the "RMB500 million club" include Lancome, Shiseido, Winona, The history of whoo, Guerlain, and OLAY. Winona is the only local brand that ranks in the "RMB500 million club".

In the "RMB100 million club”high-end brands still occupy most of the seats, including Helena, CPB, Fresh, Kieh'l, LA MER, QuadHA, YA-MAN, Sulwhasoo, Proya, SkinCeuticals, Clarins, La Roche-Posay, Cosme Decorte, SK-II, Sisley, Dr. Yu, Dr.Jart+, ELIXIR, Elizabeth Arden, Freeplus, Armani, YSL, Ulike, IPSA, CHANDO, MAKE UP FOR EVER, Zhuben, Donginbi, Dr.Ci.Labo, AUPRES, L'OCCITANE, Laneige, Shu Uemura, UNISKIN, Curel (*ranked by sales).

03

New domestic products open a new horizon

Looking at the data, as consumers gradually have become more rational in understanding brands and making market judgments, new domestic products have become another choice for the new generation of consumers.

According to the data of JD Beauty, in the first 10 minutes after the opening of Double 11, 35 new brands such as Dr.Alva, Abby's Choice, and KIKO recorded YoY pre-sales overall growth of more than 200%. It is worth noting that Winona and Proya were among the list of top ten skin care products with highest pre-sales for the first time.

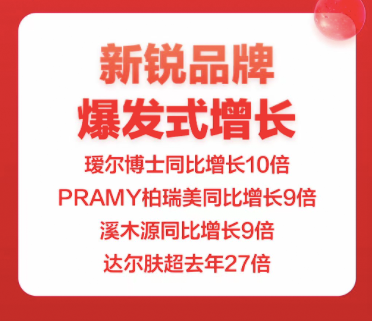

At the same time, the new domestic brands also witnessed explosive growth. Dr.Alva, PRAMY and DR.WU recorded YoY pre-sales growth of 10 times, 9 times and even 27 times, respectively. The new domestic skin care brand Simpcare has entered the functional skin care track with its excellent product strength since its establishment in 2019. At present, it wins the attention and recognition from consumers and industry insiders by virtue of its five strong functional product series, and is known as "the light of domestic products". During Double 11, the brand achieved YoY pre-sales growth of 9 times in JD Beauty.

On Tmall, the effective pre-sales of KIKO's in the first 10 minutes exceeded that in the first day of pre-sales last year. The estimated pre-sales of HBN in the first 1 minute exceeded that in the entire pre-sale cycle of last year. Dr.Alva's pre-sales in the first 90 minutes exceeded that in the first day of pre-sale lastyear. OVF pre-sales in 4 hours exceeded first day pre-sales of last year, with a YOY growth rate of 1400%.

More importantly, Winona has joined the "RMB500 million club" in the market competition with foreign brands. In addition, Proya, CHANDO, Zhuben, UNISKIN, Dr. Yu and other domestic brands have successfully entered the "RMB100 billion club", indicating that domestic beauty brands have begun to write a new chapter in the beauty market.

04

The rise of perfume and men?

The potential of the sub-divided track is fully demonstrated

The new consumption area has always been a hot area that capital and brands pay attention to, and in this area the beauty category bears the brunt of becoming a hot track for capital betting. In September 2021 Tmall upgraded men and perfume to "independent segments." These four categories will be separated from the original segments for independent operation and become the first-level business on Tmall.

Tmall Beauty has also set a new goal this year: to build 5-10 beauty groups with annual sales of more than RMB10 billion, and 100 new beauty brands with annual sales of more than RMB100 million,within three years.

Tmall's data on Double 11 this year has once again proved that the new tracks of fragrance and men have a bright future. According to the data, the estimated pre-sales of fragrance and aromatherapy industry in the first hour grew 198% YoY, and the effective pre-sales of this industry in the first hour exceeded that in the first day of pre-sales last year. The men's care industry, another category classified as a new track by Tmall Beauty,recorded in the first 80 minutes pre-sales higher than that in the first day of presale last year, and saw YoY pre-sales growth of 85% in the first hour of presale.

05

Distributor operations are blooming.

Are the live-streaming channels loath to lag behind?

In terms of distributor operators, the sales data on the pre-sale day was also very eye-catching. It is reported that the Freeplus Tmall Official Flagship Store operated by Lily&Beauty saw huge transactions with pre-sales of more than RMB100 million in merely 14 minutes of the first day of pre-sale. The star product Amino Acid Facial Cleanser recorded sales of more than 3.2 million units in 4 hours, representing a YoY increase of over 100%. It is worth mentioning that Freeplus has been ranked No.1 in the Tmall Double 11 cleansing category for 5 consecutive years. For another distributor operator Syoung Group, their stores also recorded GMV of over RMB300 million in the pre-sales.

At the same time, live-streaming is still the most direct sales path in the beauty field. According to the Taobao streamer sales list, Li Jiaqi and Viya achieved final live-streaming sales of RMB10.653 billion and RMB8.252 billion, respectively, followed by Cherie with live-streaming sales of RMB930 million. Until the end of the live-streaming, there were nearly 500 million viewers in the live-streaming rooms of Li Jiaqi and Viya.

According to data from Tmall, the beauty live-streaming pre-sale in the first hour exceeded that in the same day of last year, and the beauty live-streaming pre-sale in the first 4 hours surpassed that of live-streaming in the whole period of Double 11. In the first 4 hours of beauty live-streaming pre-sale, 30 brands recorded pre-sales of over RMB10 million in their self-live-streaming rooms; in the first 1.5 hours of pre-sales, the self-live-streaming rooms of beauty brands recorded pre-sales of over RMB1 billion. The pre-sales of Estee Lauder and Lancome in their self-live-streaming rooms exceeded RMB100 million in the first 2 hours of pre-sale, more than all other Tmall merchants together.