- 2024-01-26

- 阅读量:6830

- 来源|Cosmetic Business Online

- 作者|Zhu Cong

Procter & Gamble will reduce "significant price increases" in the future.

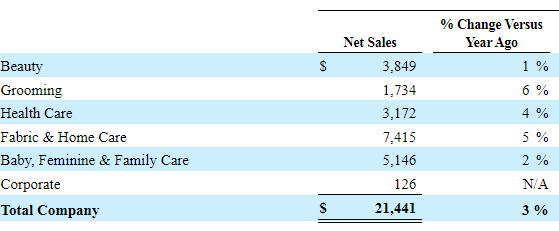

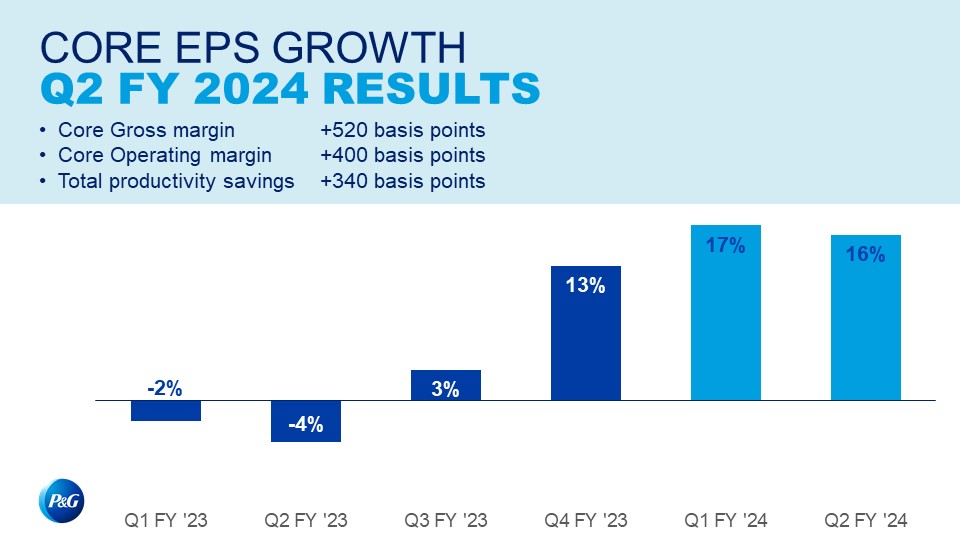

On January 23, Procter & Gamble released its fiscal 2024 second quarter (October-December 2023) financial results with the following key operating data:In Q2 FY2024, Baojie reported sales of $21.4 billion (RMB 153.5 billion), up 3% year-on-year, with organic sales up 4%; net attributable profit of $3.5 billion (RMB 25.1 billion), down 12% year-on-year; cash flow from operations of $5.1 billion (RMB 36.6 billion); and core net income per share of $1.84 (RMB 13 ), an increase of 16% year-on-year, exceeding the market's general expectations.

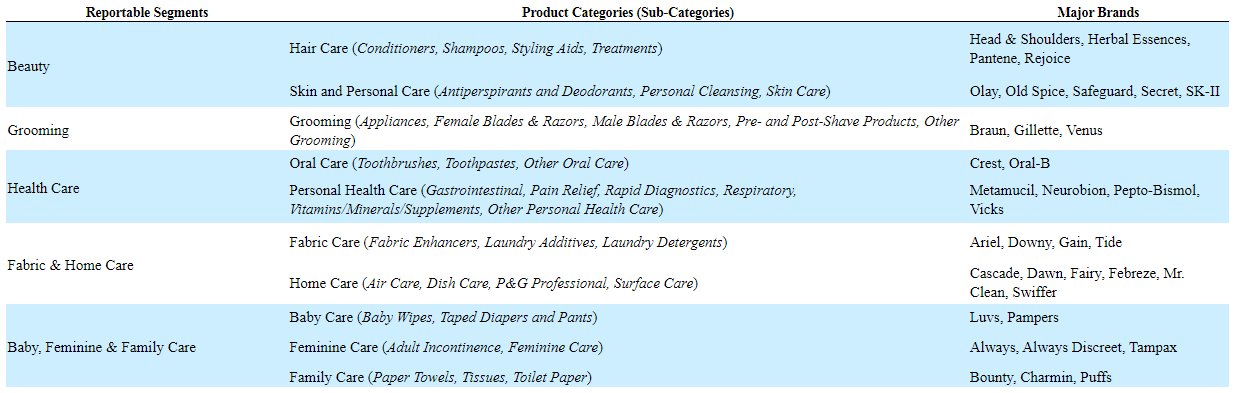

Q2 saw growth across all business segments, specifically, the Home Care division was the Group's top division with a 35% share and organic sales up 5% year-on-year. Second was the Baby, Feminine and Home Care division with a 24% share and a 2% year-on-year increase in organic sales. Third was the beauty division with 18% share and organic sales up 1% year-on-year. The Hair Care division was the fastest growing division with organic sales up 6% year-over-year and 8% share. The Health Care division had organic sales growth of 4% year-over-year and accounted for 15% of the total.

In its earnings report, P&G announced plans to reorganize its limited-market portfolio, primarily in markets such as Argentina and Nigeria.

Notably, Gillette's intangible assets were impaired by $130 million, primarily due to an increase in the discount rate, the depreciation of several currencies against the U.S. dollar and the impact of the non-core restructuring program described above.

P&G expects to maintain full-year sales growth between 2% and 4% in fiscal 2024.

01

22 consecutive quarters of 4%+ organic sales growth

"Overall, revenues continue to be strong, and P&G has achieved its 22nd consecutive quarter of organic sales growth of 4% or higher, primarily attributable to accelerating market volumes and a combination of market share gains."

During the earnings call held on the day of the earnings release, Jon Moeller, P&G's chairman of the board, president and chief executive officer, noted that the October-December quarter just past was a strong one, delivering strong results for P&G, notably core EPS of $1.84, an increase of 16 percent over last year.

Based on the natural year (January-December), Procter & Gamble's total revenue in 2023 exceeded $601.9 billion for the first time.

02

SK-II fell 34% in Greater China

Chinese consumers' boycott of Japanese beauty products was also named in the earnings report.

Anti-Japanese brand sentiment in the Chinese market drove down sales of SK-II brand skin and personal care products due to the release of wastewater from the Fukushima nuclear facility.

"Sales of the SK-II brand in Greater China, including the domestic travel retail channel, fell 34%." Andre Schulten, P&G's chief financial officer, revealed, "However, our branded consumer surveys show that mass resistance to SK-II is improving and we expect to see continued improvement and a return to mid-single digit growth in the second half of the year."

Dragged down by SK-II, Procter & Gamble's beauty division saw single-digit net sales declines in the skin and personal care segment, with Asia-Pacific sales down more than 20% and Greater China sales down nearly 10%. In addition, the health care division's oral care products also saw sluggish sales in China due to price increases.

In the face of this dilemma, the leadership of Procter & Gamble, a hand Jon Moller also led a team in China for six days in early 2024.

"I met with consumers in their homes, with the team's retail CEOs and with several government officials. I think the short term may present some challenges, but the long term opportunities in China are still worth looking forward to."

It is worth paying attention to, P&G will reduce the future of "substantial price increases".

Price increases have become a common keyword for international beauty giants over the past few years. Price increases have boosted P&G's sales significantly, but P&G officials point out that the future price increase strategy will slow down to better adapt to market changes.

"We expect the contribution of pricing to revenue growth to decline by a further 1-2 percentage points in the second half of this year. While we cannot speak to the details of future pricing in any market, more stable FX and commodity costs will ideally reduce the need for further significant price increases."