- 2020-12-25

- 阅读量:2747

- 来源|CBO

- 作者|Cong Zhu

Have you been tired of reading the high-frequency words about beauty collection stores appearing in the notes of various Red Home bloggers, including the beauty blender wall, lipstick wall, Internet-famous photo area, industrial style, "women's paradise", "impossibility to leave empty handed", "making up your face", sense of technology, "a must-go store for student shoppers", stainless steel shelves, "self-service makeup supermarkets", one-stop shopping, self-service shopping, free makeup trials, X00-plus brands, X000-plus single products?

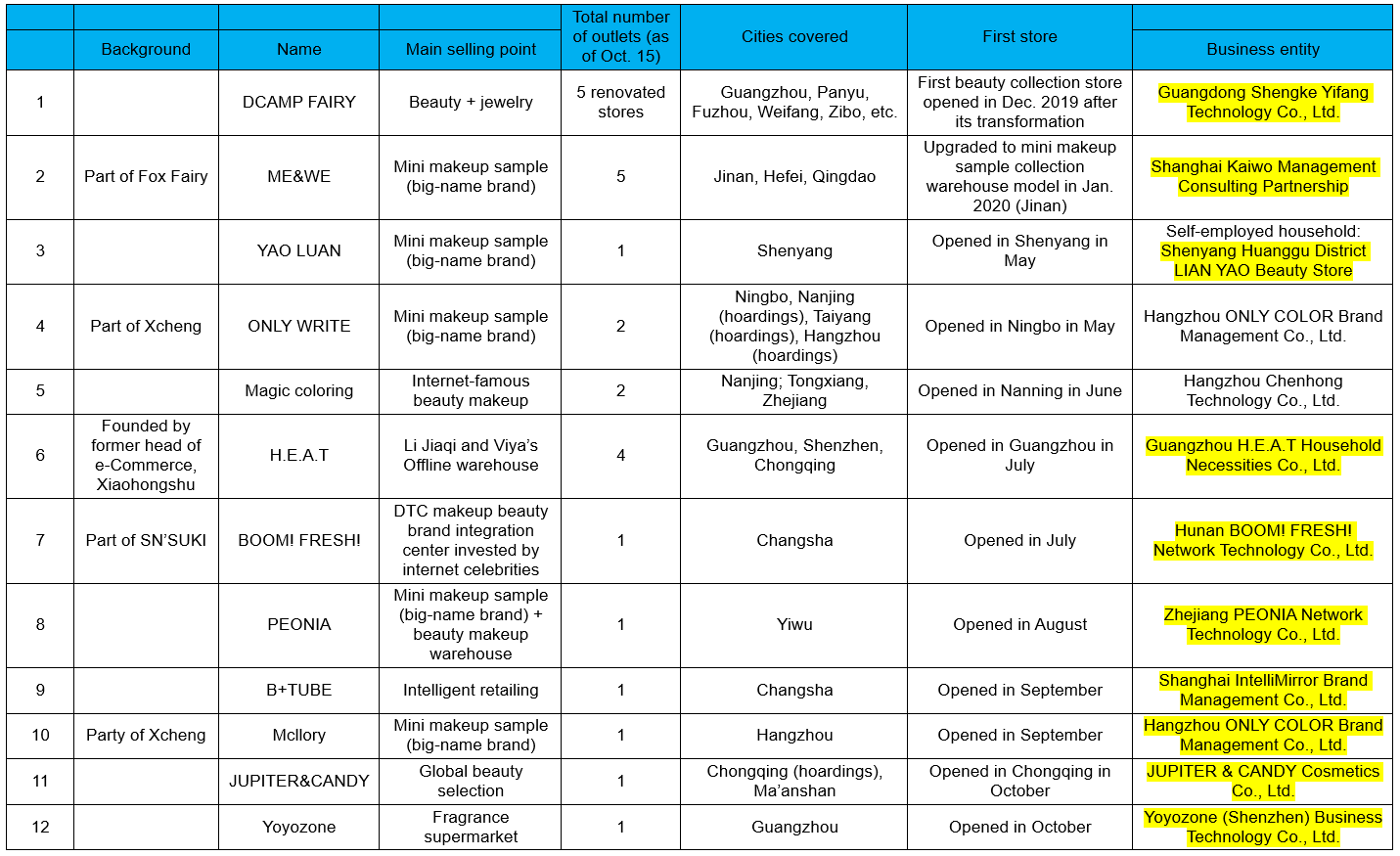

Since the launch of THE COLORIST, the first large-scale beauty collection store in China, last September, "large-scale beauty collection stores" have popped up everywhere. According to the statistics from CBO, since May, many "beauty collection stores" have exploded in shopping malls across the country to respond to “compensatory consumption”. Some of them were transformed from commodity department stores, some from traditional cosmetic stores, and some were just exploring a different sector in a cross-over trial for the first time.

According to the statistics from CBO, from the perspectives of store area, number of stores, urban outlets coverage, and consumer awareness (number of mentions on social platforms), THE COLORIST and HARMAY, powered by the capital market, have had a first-mover advantage. As more and more beauty collection stores are getting involved, the competition becomes increasingly fierce. Can latecomers capture this historical opportunity for a piece of the pie?

01

Imitation

Homogenization of decoration and product selection

"Warehouse + mini makeup sample" becomes the main model

Wu Yuening, founder of KK Group, THE COLORIST’s parent company, once predicted that hurt by the Covid outbreak, offline business reshuffle would accelerate and the brands that survive would become stronger and more competitive. The rent increases of shopping malls that were unchanged over the years have been adjusted accordingly. A multitude of international makeup brands and domestic trendy brands have barged into the market. The homogeneous competition of the supply chain has caused makeup prices to plunge, which benefits a broader range of consumers. The lack of business format of beauty collection stores has made dislocation competition and low-end disruptions possible.

The vacancy rate of shopping malls has increased, and the business format of beauty collection stores has become a new favorite after the COVID-19 pandemic. As consumers can see, the collection store brands as newcomers are very much alike in terms of the use of color, renovation design and more, indicating that their target customer group and brand positioning are highly homogenized.

1. Similar image and coincident product selection

These new style beauty collection stores are usually located on the first floor of a shopping mall with the most customers in the core catchment area. Compared with traditional beauty shops, they have more exquisite design and more eye-catching decoration, and feature low-cost Chinese national makeup products, while introducing big-name overseas brands.

△ Brands in Dcamp Fairy stores

△ Brands in Only Write stores

As The Colorist type of stores are blooming everywhere across the country, a deluge of latecomers who are good at learning have also followed their lead. They are all busy "selecting the best-selling products on the whole network, ranging from trending single products and foreign niche brands to various domestic trendy brands and big-name international brands".

△ Magic coloring

The practice of new entrants wasting no time is also reflected in the fact that some collection store brands such as Magic Coloring are even still applying for their trademarks.

2. Big name brands’ low-priced mini samples are used for inbound marketing, and small and medium sized brands focus on increase in gross profit.

Disassembling high-priced products from top brands into mini makeup samples with a low unit price empowers consumers with a higher “touchability”. Since HARMAY hit the ground running with its "warehouse + mini makeup sample" model, the inbound marketing effect of the "mini and medium makeup samples" is already obvious to all, and many stores have made the "big name’s mini makeup sample" their primary selling point. The huge appeal of big names’ “low-priced” mini and medium makeup samples have been mentioned in almost all the notes about visiting stores on Red Home. For example, “LA MER for 39 yuan”, “Lancôme for 19.9 yuan”, and other similar titles can often be found in Mcllory’s notes posted on Red Home.

△ A price list of the products in YAO LIAN’s cosmetic stores

Very similar to HARMAY, the YAO LIAN beauty collection store in Shenyang also started its business online and ended up establishing its physical stores. It has opened online stores from Taobao to Weidian for years, and is viewed as a "withdrawal center" among local customers in Shenyang. YAO LIAN didn’t open a physical store until earlier this year.

△ peonia

PEONIA, which opened in Yiwu, Zhejiang Province this July, also "copied" HARMAY almost as it is, but changed its dominant hue of the goods shelf to green. With 40-odd brands from Europe and over 1000 SKUs, it positions its publicity slogan as "We have genuine and traceable goods in stock, and the price is lower than that offered by the online shopping distributors".

△ Suning Jiwu

In addition, included in the use of "mini and medium makeup samples" for inbound marketing is Suning Jiwu which is very popular recently. It opened four stores at the same time during the National Day. With the trending products from premium brands, Suning Jiwu successfully attracted many female consumers to check in the stores and do shopping. If searching for Suning Jiwu on Red Home, you will find that there are thousands of related comments, which have drawn the attention of quite a few Internet celebrities. Up to now, Suning Jiwu has renovated over at least 7 of its stores (Nanjing, Beijing, Changsha, Wuxi, Chongqing, Shanghai, Zhenjiang), and focused its marketing efforts on "Internet-famous beauty collection stores", but it has been ridiculed a lot with comments such as “the makeup area is small”, "mini and medium makeup samples are expensive" etc...

△ Suning Jiwu’s makeup area was roasted by netizens

02

Innovation

Focus on new retail and blind box

Or on photo gallery and olfaction collection hall

There are also innovative players.

△ B+TUBE

IntelliMirror, which once provided smart retail marketing solutions for Sephora, Cartier and other brands, has incubated a distinctive beauty collection store, B+TUBE. In collaboration with MeituGenius, a part of Meitu, B+TUBE provides AR virtual makeup trial, skin quality testing and other services in stores. As for display, B+TUBE takes an innovative approach to display its products from the dimensions of color number, texture, efficacy and others. Each category is available with two options: big-name brand’s products and affordable alternatives. When a product on the smart shelf is picked up and placed above the induction area, the screen will display the product presentation and the reasons for choosing B+TUBE.

BOOM!FRESH!, which was opened in July, is a new kind of DTC beauty collection store invested in by an internet celebrity. As the "upgraded version of SN’SUKI", the store is also equipped with the skin care machines imported from South Korea.

Mcllory and ONLY WRITE are quite ingenious in terms of innovation activity by introducing the "Blind Box" that is the favorite of young people nowadays. Mcllory's activity of spending 99 yuan to open a Blind Box is very popular.

H.E.A.T, which is positioned as "Li Jiaqi and Viya's offline warehouse", launched a flow mechanism for product selection. The new store in Baiyun Guangzhou even introduced a mini powder press machine to allow consumers to customize their own exclusive eye shadow palettes.

△ The powder press machine introduced by H.E.A.T

There are also newcomers from different segments.

For example, D-Camp Fairy was originally called D-camp which operated daily necessities and even still advertised shoes through its official accounts in November 2019. At the end of last December, the description in its “who am I” section was changed, becoming "We are a new beauty retail chain brand, bringing together premium global beauty brands."

△ Transition of D-camp fairy’s positioning

D-Camp Fairy also provides packaged kits for sales to consumers with trouble deciding what to buy, as well as photographers who stay in the store all day to take photos for consumers free of charge. Its service awareness is comparable to Haidilao. Data shows that the Zibo R&F Wanda Plaza store was opened on July 30, and the daily sales revenue exceeded 250,000 yuan, with over 1,000 sales orders on average.

△ D-camp fairy store in Zibo

A special new player, "Yoyozone", appeared on the beauty collection store track.

△ An official store photo published by Yoyozone

Yoyozone is an emerging fragrance brand collection store, which was officially opened in Yuehui City Shopping mall, Guangzhou on October 22. This is a fragrance supermarket targeted at the post-90s and 00s generations. Unlike perfume collection stores such as "Odor Library" and "Fragrance Museum", Yoyozone has broken the concept that only perfume and aromatherapy can enhance fragrance, and introduced more domestic hand-made original high-quality fragrance cosmetics and daily cosmetics to complement its SKUs.

03

Top 100 chains enter the game

Targeting second and third-tier cities

According to the statistics of CBO, unlike THE COLORIST and HARMAY, both of which prioritize their locations in Beijing, Shanghai, Guangzhou and Shenzhen, the top 100 chains prefer to select the second and third-tier cities, especially in cities of Jiangsu and Zhejiang as the sites of their beauty collection stores. Chongqing and Changsha, two internet-famous cities that have been sought after by young people in the past two years, are also their sites of choice.

Newcomer Jupiter & Candy (focusing on “global beauty selection”) selected ChongQing as its first site. Two upcoming stores are located in Chongqing and Maanshan, Anhui, respectively.

△ JUPITER&CANDY

During the Covid pandemic, offline physical stores suffered a huge impact, with sharp decrease in customer flow. In the post-epidemic era, an increasing number of consumers are attracted by those novel and fun collection stores, and traditional cosmetic stores also feel threatened. It is not difficult to understand why there is still no lack of local regional cosmetics chains entering the game to incubate "new kinds of stores", though the competition in the beauty collection store market is gradually heating up.

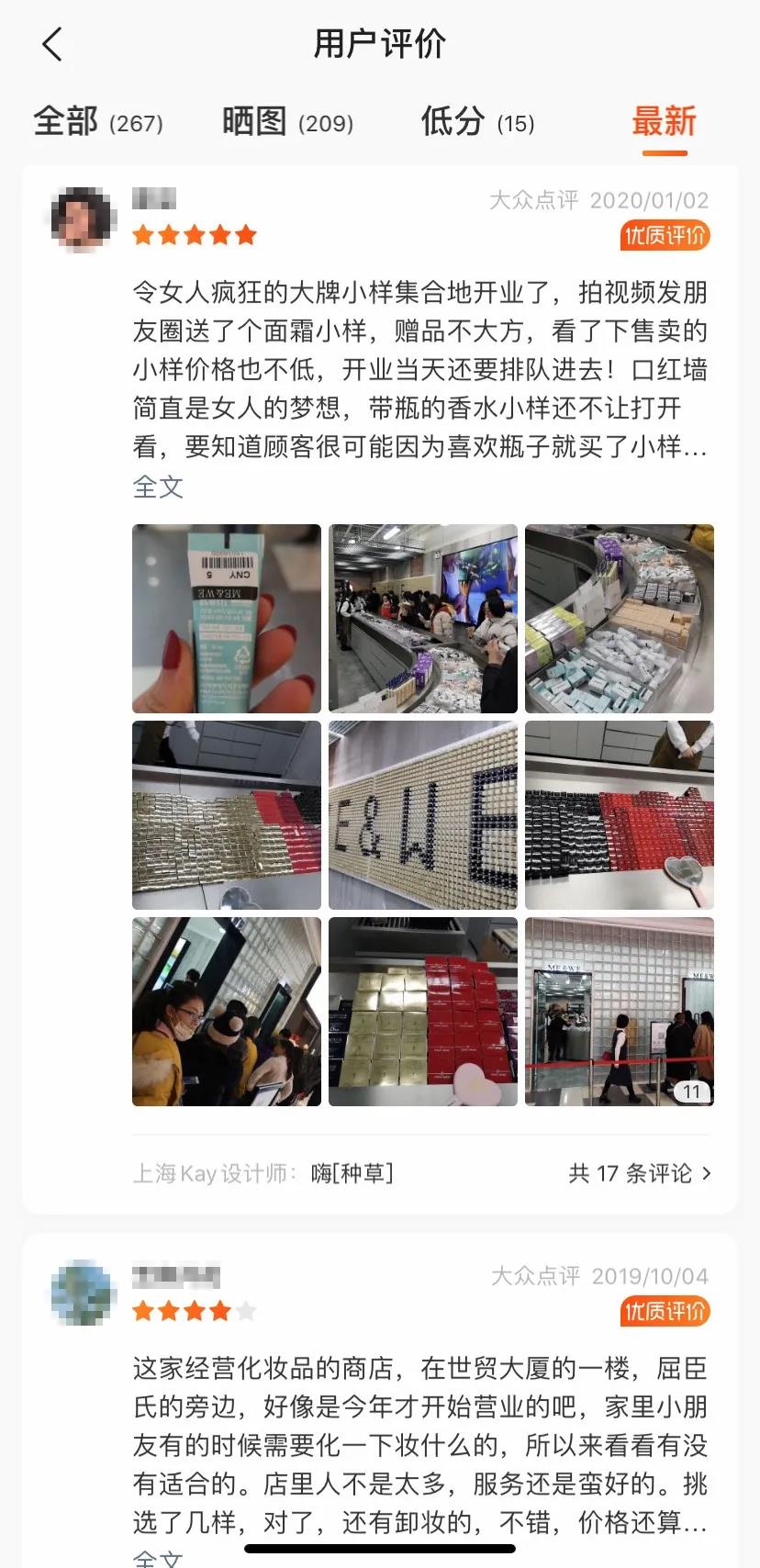

ME&WE, which is based in Hefei, currently focuses on the concept of "big-name brand collection store", and is also reliant on the strategy of leveraging mini makeup samples for inbound marketing. Previously, ME&WE was a premium collection store brand launched by HULIXIAOYAO(Fox Fairy), one of the top 100 chains, at the end of 2018. It has not been very popular. The ME&WE store in Jinan was renewed and launched the “mini makeup sample” model in January of this year. Pictures of standing in long queues at the door have often been uploaded by consumers since then. Because of this success, ME&WE quickly switched its directions and renovated all of its 3 stores in Hefei.

△ A comment on Dianping tells the difference before and after the renewal of ME&WE Store Jinan

Wang Pei, General Manager of HULIXIAOYAO(Fox Fairy), explained on the "matter of ME&WE's positioning" in an interview: "We originally just wanted to make it a high-end store brand, but after listening to a course about positioning at the end of last year, we found that simple high end is very broad and unclear. When the second ME&WE store was about to open, we preliminarily positioned ME&WE as a big-name brand collection store."

△ mcllory

Coincidentally, Zhou Jianlei, the owner of Xcheng, opened two new collection store brands Mcllory and ONLY WRITE this year. It is understood that the two stores have brought together almost all home-made trendy makeup products and hot-selling self-selection makeup products worldwide with the support of Xcheng's supply chain.

In May this year, ONLY WRITE, a new beauty collection store, which is called an "upgraded version of THE COLORIST" by industry insiders, settled in the Wanda Plaza in Yinzhou District, Ningbo. The store, with an area of over 200 square meters, had a turnover of 470,000 yuan in as little as three days after opening which instantly drew the attention of industry insiders.

△ ONLY WRITE

It was learned that Zhou Jianlei claimed he planned for the two stores for at least six months. Like most new beauty collection stores, their visual effects are mainly simple, stylish and fancy. In addition, ONLY WRITE also provides a live streaming room, a perfume cabin, a bath cabin and a makeup trial cabin in the store, attracting Internet celebrities and young consumers to check in.

According to the staff, ONLY WRITE is currently in the stage of trial operation, and the total number of stores (including enclosures) cannot be disclosed to the public. Judging from the check-in notes displayed on social platforms, the Ningbo Yinzhou Wanda Plaza store is currently in operation, and the store in Taiyuan will open on October 23, followed by the stores in Hangzhou, Nanjing and other places soon.

△ BOOM!FRESH!

BOOM!FRESH!, an "upgraded version of SN’SUKI", was born with the DNA of being an internet-famous place. The store is equipped with a communication and sharing area and a live streaming area, where not only do online influencers come to stream activities live to share their views on beauty makeup to their followers from time to time, but also there are live makeup classes organized by leading brands. Although there is only one store in Changsha, BOOM! FRESH! 's ambition is not limited to this. It will roll out more stores in first and second-tier cities across the country in the future.

Whether the spring of new beauty collection stores is coming is still unknown, but judging from the "check-in" notes that are growing endlessly on Red Home every day, at least for consumers, the more players there are on the beauty collection store track, the better it will be. Countless latecomers are still entering the arena in a steady stream. It’s hard to predict who can win the competition – only time will tell.