- 2020-12-25

- 阅读量:2436

- 来源|CBO

- 作者|Jiang Wen

The COVID-19 pandemic puts travel and tourism on pause, while stifling duty free shops. How can the travel retail market currently in danger of collapse survive?

Offline channels have been badly affected due to the Covid-19 pandemic.

The majority of department stores were closed for 1-2 months in the first quarter, during which there was almost no cash flow. Even if opened for business, they were anxious due to the decline in customer flow. Such a situation still continues. Across the country six or seven department stores have been closed as a result.

Cosmetic stores (CS) in China are also facing the challenge of customer flow loss. Nearly half of beauty shops believed that their annual revenue will decline by 10%-30% according to a CBO survey. Learning live streaming and enhancing community operations have become the normal duties of these shop owners and their shop assistants. However, there are not many stores that have gained live streaming dividends so far. Most stores can only survive for another 2-4 months, and reforms that can save the situation are still under exploration.

Duty free channels categorized into the travel retail sector are in even more of a fatal crisis.

Against the backdrop of the global pandemic that is currently ongoing, countries have further strengthened their own international air traffic control. An important hub for entry and exit, the airport is closed resulting in a sharp drop in passengers. Duty free shops whose operations are reliant on airport passengers can only come to a halt and lose their source of cash flow.

Compared to department stores and cosmetics stores, on the one hand, duty free channels are characterized by larger stocks and insufficient flexibility. When the goods are difficult to sell, those soon-to-be expire goods will cause great losses and waste. On the other hand, in the process of trying to survive, the co-operation with various cloud platforms will pose new challenges.

01

Dispairing duty free shops in various countries

Let's first have a look at South Korea.

As a country with well-developed travel retail, South Korea, the "goose that lays the golden eggs", has been severely affected by the pandemic and a succession of stores closed has caused its overall sales to be paused. Since April, the average number of inbound and outbound passengers per day in South Korea has dropped from 100,000 to 2,000, and the overall sales of duty free shops have decreased by 90% year-over-year according to CCTV news.

The high rental cost and huge inventory backlog together weigh heavily on the Korean duty free shops.

It is reported that the duty free shop industry in South Korea has overstocked duty free goods worth billions of yuan. A large amount of duty-free goods in stock will be destroyed according to the mandates of the Korean government. Insiders predict that if there are no strong bail-out measures, the Korean duty free shop industry may face collapse in a few months.

Now, let’s take a look at Japan.

In previous years, the period from New Year’s Day to the sakura season in March was the peak period for Chinese tourists to travel to Japan. This year the pandemic acted quickly on Japan's tourism industry where tourist crowds are no longer seen. Some Japanese coach tour companies have begun giving two-month reduced pay holiday and some duty free shops have begun to lay off employees according to Xiaoxiang Morning News.

At present, the global border control is still strict and many consumers will temporarily suspend travel as a result of the pandemic. It can be predicted that it will be hard to ease the sales downturn facing the duty free shop industry in the short term. According to GlobalData, the Korean tax-exempt market will lose at least US$ 5.5 billion during the pandemic, while the Asia-Pacific tax-free market will rack up US$ 8.3 billion in losses.

The fragrance category, responsible for 30%-40% of sales, bears the brunt of these losses among them.

02

Travel retail shifted from racing to crawling in the first quarter

As a matter of fact, this channel has gradually become a foremost sales channel for leading skincare brands with the boom in travel retail in recent years. Although the proportion of global retail sales for many multinational groups is not too high (travel retail accounts for about 9% for L'Oréal Group), many groups regard it as a growth booster.

In 2019 both L'Oréal and Estée Lauder’s travel retail channel had a growth rate of over 25%. For the former, travel retail was one of the fastest growing channels, while for the latter the the sales in travel retail in major airports worldwide had exceeded that of its department stores in North America. In the same period, the total sales of Shiseido Group's travel retail reached 100 billion yen (about 6.5 billion yuan RMB). Clarins Group also stated that its growth rate in travel retail had exceeded that of the overall market.

Today, travel retail has been hit hard, which had a direct impact on the overall sales of these large companies in the first quarter.

According to the financial report released by L'Oréal Group, with the gradual closure of airports and shops and the stagnation of air traffic, the travel retail market in all regions has declined. LVMH's duty free shops (DFS) have also been greatly affected. In addition, P&G's premium skincare brand SK-II fell by double digits in the first quarter, mainly due to weakness in travel retail.

(A DFS in Causeway Bay, Hong Kong)

Obviously, the travel retail frustrations have dealt a massive blow for these corporations.

03

Cloud deployment helped temporarily relieve stress on sales

Hit by the pandemic, the duty free shop system relying on store operations has begun to ramp up online deployment to survive.

For example, the Sanya International Duty Free Shopping Complex, the Haikou Meilan Airport Duty Free Shop and duty free shops in Haikou and Qionghai have launched the program to allow visitors to buy duty free products online after leaving the island under Haikou Customs stimulus measures, and a special online mall was launched along with an intensive discount promotion –20% off when purchasing 5 products – in an attempt to stimulate sales.

As it turns out, this kind of stimulus is effective in a short timeframe. It is understood that the day after the business resumption of the Sanya International Duty Free Shopping Complex through its online platform, its sales exceeded 44.28 million yuan, setting new single-day record for its online sales.

It is not only duty free shops but also brands that want to stimulate sales. On February 17, the "Estée Lauder Special" event was launched on the online malls of Sunrise Duty Free and several other duty free shops owned by China Duty Free (CDF) in the Sanya, Haikou, and Baiyun airports. The group’s multiple brands offered 40% off for up to 3 items, which was an almost unprecedented discount. This news became immediately the spotlight among consumers through personal shoppers.

Searching for keywords such as "60% off with Sunrise" on social software, you will find that many users shared their experiences of capitalizing on the discounts by hoarding a large quantity of goods during the pandemic, and that some consumers have begun to actively seek personal shoppers.

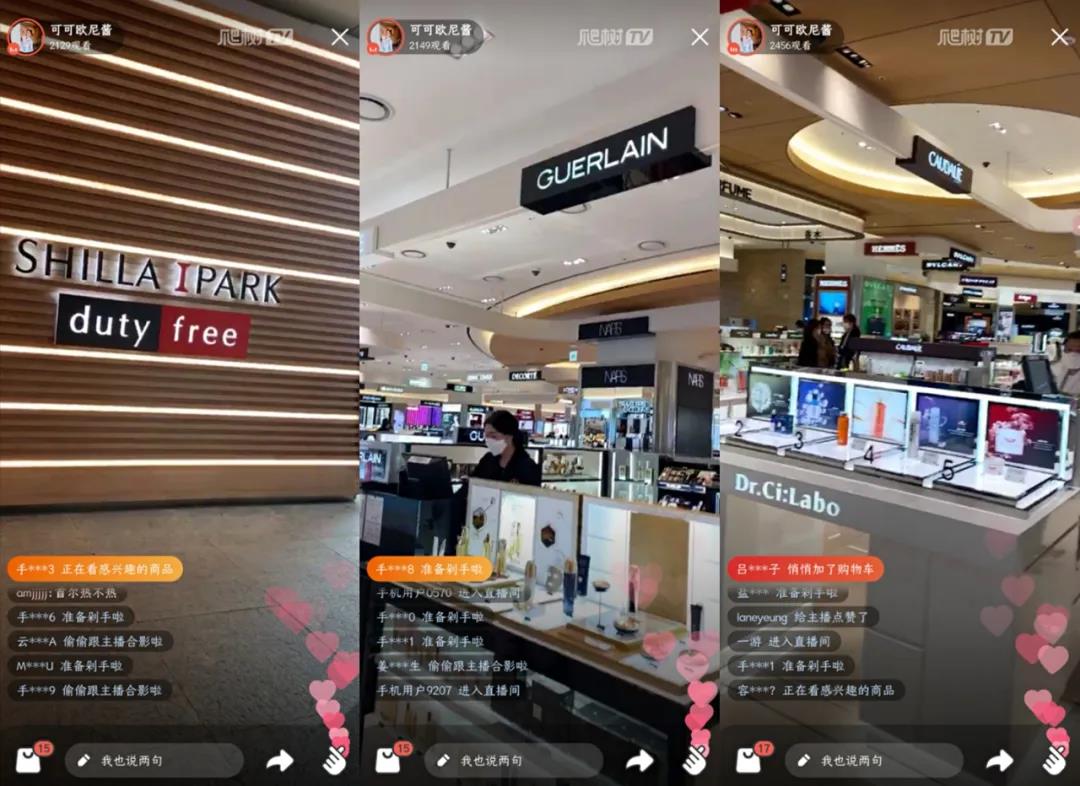

South Korea’s Shilla IPARK Duty Free launched two live streaming events on the cross-border e-commerce platform Koala on March 26 and April 24. In addition to showing the store through live streaming, Shilla IPARK also offered the live streaming platform more discounts, where consumers could enjoy the One-day Black Card of the duty free shop with the koala Black Card membership. Some counters also offered further reductions on up to 5 items.

It can be found that strong bargaining power, sufficient inventory and product guarantees bring unparalleled advantages to duty free shops after "cloud" deployments, and “cheap” has become the strongest selling point for attracting customers. However, an industry insider also clarified to the reporter the worries behind the duty-free shop: As one of the distribution channels of leading skincare brands, the duty free shop indeed offers prices that are attractive enough, but the lack of after-sales service and membership operations, together with the possibility of disorganized supply of goods after going online, will get in the way of the development of its online model in the future.

These problems may be solved by the platform in the future. “In the context of the global pandemic, factories have shut down operations and offline stores have adjusted their business hours, but domestically customers shopping for overseas products is surging. Next we will try to connect more global duty free shops and lead more consumers with a shopping spree to purchase the products from across the globe online," said the person in charge of Koala.

Judging from from the current situation, the impact of the pandemic on the global tourism industry will continue for a long time. After taking the first step of going online, how do duty free shops maintain their advantages in price negotiation and supply of goods? What stimulus measures will the leading skincare brands take on travel retail channels? CBO reporter will stay tuned for more updates.