- 2022-01-17

- 阅读量:10125

- 来源| Cosmetic Business Online

- 作者|

Continuing focus on high-end skin care, Shiseido sold 15 mass brands and cosmetics brands within one year.

Shiseido is selling its brands again!

Today (January 13), CBO learned from Shiseido China that the company has decided to sell its brands Za and Pure & Mild to URUOI, a beauty brand management group. URUOI will be responsible for planning the future development for the two brands. Shiseido will provide support for the production of related products during the transition period.

It is estimated that the transfer transaction will be completed in March this year. Shiseido did not disclose the specific transaction amount.

It is reported that URUOI is a beauty brand management group, with an omni-channel operation ability centered on consumers, that is particularly well-known for its online business operation ability. "We believe URUOI is an ideal partner and is able to take the two brands to a new height."

01

There Were Indications Early On

After the Pandemic, Pure & Mild was On Pause, and Za Received Criticism About Limited Product Variety

Za and Pure & Mild are no strangers to Chinese consumers.

After 41 years in China, Shiseido has successively "tailored" the three brands of Aupres, Pure & Mild and URARA for the Chinese market, with an ambition of integrating in the Chinese market with multiple matrices and channels.

In 2001 Pure & Mild was born as a professional plant-series skin care brand especially designed for Chinese women. It is the first cosmetics brand created by Shiseido for the Chinese market, and it is also the first brand of Shiseido to integrate in the CS channel. In the past twenty-one years, Pure & Mild has played a leading role in the development of Shiseido's CS channel in China. Both in the subsequent channel upgrade and the adjustment of the channel dividend system, Pure & Mild has been leading by example.

However, the CBO reporter has been told from time to time in recent years that Pure & Mild has been having difficult time offline.

Some store owners said that Pure & Mild's brand image is not that clear, and its customer stickiness is not on a par with that of its sister brand URARA. The owner of a store in Jiangsu even said that since 2016 Pure & Mild has not been selling well offline, but URARA has been selling better and better with its strong services and great customer stickiness. "In 2019, I sold over 2 million RMB Shiseido products, and URARA accounted for 70%, Elixir 20%, and Pure & Mild less than 10%". The store owner predicted that in view of URARA's terminal training and product upgrading in the past two years, URARA will likely have even higher than expected proportion of sales among Shiseido products.

In view of the difficulties in sales in recent years, Pure & Mild did make some changes. Since 2016 it has taken a series of measures such as signing agreements with Zhao Liying, updating counters, and launching new skin care products. As the interviewee mentioned above, Pure & Mild also adjusted the CS channel’s supply discount from the original Pure & Mild. However, with the CS channel falling into difficulties, the proportion of cosmetics channel has been inclined to gravitate towards e-commerce year by year, and the sales of Shiseido’s high-end brands has continued to boost the performance of the Group. Under this background, Pure & Mild gradually found itself in an awkward positon within the Shiseido Group.

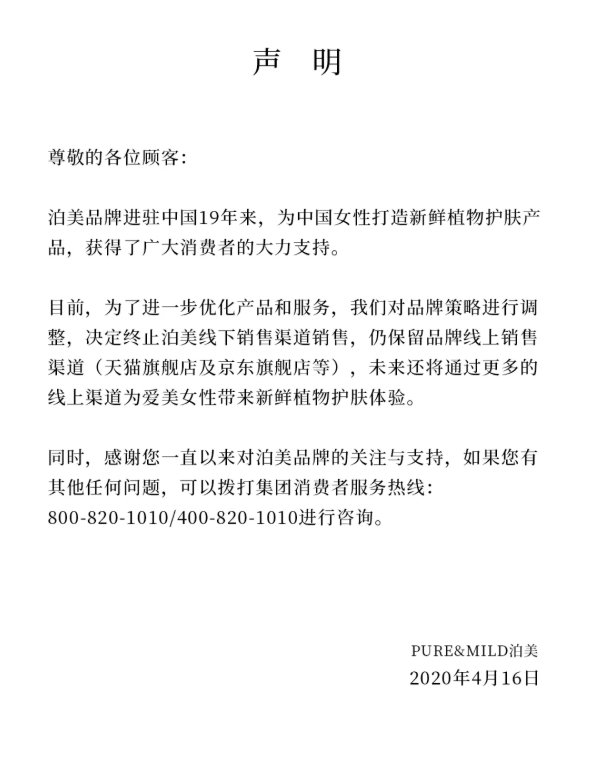

In April 2020, Pure & Mild announced via its official website & WeChat that it decided to terminate its offline channel sales. Although Shiseido denied that Pure & Mild brand would withdraw from the Chinese market at the time, many channel operators interviewed expressed that they were “mentally prepared”.

Za, founded in 1997, is a moderately-priced make-up brand designed by Shiseido Group for young women. Its trump card, True White Day Protector, has been selling so well in the Asia-Pacific region for more than ten years that it is fair to say that Za has long been a famous product for Chinese makeup newbies.

However, there are always two sides to everything. In recent years, with the unprecedented development of e-commerce, new brands have been pouring into the market. On the one hand, new brands have been continuously entering into the sun screen sub-category. On the other hand, other than their star product Pure White Day Protector, Za has not developed any other hit product. For this reason, Za’s overall brand image lags behind. Even though in 2020, Za announced the start of its journey of brand innovation to New Za, but it did not work out well.

Both Za and Pure & Mild were of strategic significance in Shiseido's early development in the Chinese market. This time it was out of far-reaching considerations that Shiseido China spun off the two well known established brands.

02

Getting Rid of the Old and Ushering in the New

Shiseido Sells 15 Brands Within One Year, introduces new brands to China One After Another.

When asked about the reasons for selling the Za and Pure & Mild brands, Shiseido China replied to the CBO reporter: "Shiseido Group is implementing its Win 2023 and Beyond medium-and long-term strategy and gradually focusing on the business structure with skin care as its core. The company is promoting business transformation and focusing on developing leading brands to strengthen its business foundation and develop itself into a global skin care group." Based on this, Shiseido believes that c and Pure & Mild need external resources to develop further.

Masahiko Uotani, Representative Director, President and CEO of Shiseido, once said publicly that Shiseido had planned to focus more on skin care products in the post pandemic era. By 2023, 80% of sales should come from skin care products, a category which currently contributes to 60% of Shiseido's sales.

Focusing on Win 2023 and Beyond medium and long term strategy, Shiseido takes the high-end skin care sector as its core business, and promotes its business reform at a deeper level. Therefore, it can be seen that the past year has been characterized by new brands replacing old ones.

Shiseido Group sold as many as 15 brands (mainly mass brands and make-up brands) in the past year.

On April 28, 2021 Shiseido Group announced at its official website that Shiseido and Dolce & Gabbana will terminate their beauty license agreement globally for the development, production, marketing and distribution of D&G’s makeup, skincare and perfume products.

On July 1, 2021 Shiseido Group transferred its global personal care business at a price of RMB9.8 billion, which involved ten brands including TSUBAKI, SENKA, UNO and AQUAIR.

On August 26, 2021 Shiseido Group officially announced its decision to sell its three makeup brands, BareMerals,, Laura Mercier and Buxom, at a transfer price of USD700 million (about RMB4.5 billion).

In addition to the officially confirmed brand transfers mentioned above, the new series “WASO” created by Shiseido Group for millennials in 2017 stopped selling in the Japanese market at the end of 2020 , and stopped its online sales in Japan at the end of 2021. However, Shiseido China told CBO: "The markets outside Japan remain unaffected. In the future, WASO will further strengthen its marketing and strategic layout in China".

Since the pandemic in 2020 the Chinese market has gradually become a betting place for foreign investors worldwide, and Shiseido China has kept introducing new products and brands into China in an effort to expand its presence in the Chinese market.

First, the across board upgrade of the existing brands.

In January 2020, Shiseido aggressively introduced its high end imported brand Revital to integrate into CS channels, and quickly set up more than 1,000 stores in the difficult business environment after the epidemic. In September 2020, the URARA high-end series (with the same production line as CPB)– Prime Treatment series came on the market, which was a heavyweight move for the URARA brand that year. In February 2021, the seventh generation cherry blossom bottle of Shiseido brand came on the market, with an agreement signed with Liu Yifei, and became the first beauty brand to hold a release conference on Bilibili. These new moves in products and marketing have demonstrated the vigor and vitality of Shiseido as a youth-oriented brand.

Second, the global launch of new brands in China.

In 2020, Shiseido Group introduced THE GINZA and BAUM brands at the 3rd China International Import Expo for the first time outside of Japan. At the same time, Shiseido also world debuted the EFFECTIM brand, a scientific and technological achievement made in cooperation with Yaman. These brands landed in the Chinese market in 2021.

In 2021, at the 4th China International Import Expo, Shiseido Group world debuted INRYU, a new beauty supplement brand. At the same time, Drunk Elephant, a pioneer brand known for "Clean Skin Care" acquired by Shiseido Group in 2019, also made its offline debut in Chinese mainland through this event.

03

With Competition between Beauty Giants Becoming More Intense

How should Shiseido Prepare Itself

for the Next 40 Years in China?

Since the outbreak of the pandemic, due to the rising cost of commodities and freight, beauty giants have experienced higher after tax costs. Therefore, beauty giants such as Procter & Gamble and Estee Lauder have raised their prices successively. High-end brands with higher premium space and stronger ability to maintain their noble images have gradually become part of the strategy of beauty giants.

Let us take a look at China. YSG (YatSen Global), which started with Perfect Diary, a cost-effective make-up brand, has successively acquired the high-end technology skin care brand Galenic based in France and the high-end natural SPA brand EVE LOM based in the UK.

Globally, high-end acquisitions almost became mainstream in 2021. In December 2021 alone, Beiersdorf acquired Chantecaille, a luxury beauty brand, and the France-based Pierre Fabre Group, Avene's parent company, acquired Ladrôme, a French natural aromatherapy skin care brand. In June 2021, Unilever acquired the famous skin care brand Paula’s Choice. In late 2020, L 'Oreal also acquired the Japanese high-end skin care brand Takami.

At present, in Shiseido China's sales e-commerce channels and high-end brands have come a long way, with the latter contributing to more than 50% of sales revenue. There were indications that the exit of the two mass brands Za and Pure & Mild would happen, and this is regarded as a microcosm of the fierce competition among the beauty giants led by Shiseido Group.

According to the 2021 Q3 financial statement recently released by Shiseido Group, in the first nine months of 2021 the performance of the Group in the Chinese market increased 23.1%. In the annual forecast, the Chinese market is expected to contribute 281.5 billion yen (about RMB15.82 billion), which is expected to account for 26.96% of the total revenue, exceeding Shiseido Group's expectation for the performance in the Japanese market. As the global pandemic enters a new normal, it is imaginable that China will become Shiseido Group’s largest market in the world.

In order to show confidence in the Chinese market, Shiseido China has never stopped its pace to reform in recent years.

First, at the brand level, it can be seen that Shiseido Global was the seller of the 15 major transactions mentioned above, and Shiseido China was the seller of Za and Pure & Mild. Second, at the investment level, in August 2021 Shiseido China established Chinese mainland’s first international beauty group special investment fund - Ziyue Fund, which is expected to invest a large sum of money to support China's new brands and jointly promote the development of the beauty industry. Third, at the scientific research level, in October 2021 Shiseido China Oriental Beauty Valley R&D Center officially opened, which is Shiseido's third largest R&D center in China, and Shiseido has also become the foreign beauty giant with the most R&D centers in the Chinese market. Fourth, at the digital level, in December 2021 Shiseido Group announced that it had reached three-year global strategic cooperation with Tencent in order to promote digitalization comprehensively.

It can be foreseen that with the exit of older brands and the entry of new brands, 2022 will probably be a watershed for the development of the beauty industry in the next decade.