- 2022-03-01

- 阅读量:3938

- 来源| Cosmetic Business Online

- 作者|

The HERA mermaid lipstick used by actress Jun Ji-hyun in "My Love From the Star" seemed to be still be of great popularity yesterday, but the HERA China offline counters have been all completely closed.

Following the withdrawal of Chinese offline counters by Innisfree and ETUDE HOUSE, HERA, a high-end brand under the Korean cosmetics giant Amorepacific Group, has successively closed its Chinese offline counters.

01

HERA has Fully Completed the Withdrawal of Counters,

The WeChat Store Will Close in Mid-March

At present, HERA WeChat Mall has discounted the whole line, with 40% off lipstick and 30% off black gold cushion foundation.

△HERA WeChat Mall has discounted the whole line.

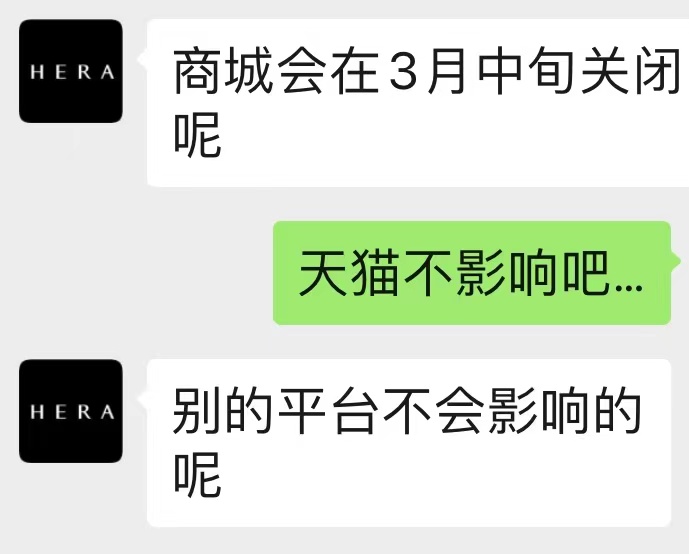

Official customer service told the Cosmetics Business Online (CBO) reporter: "HERA brand in China's offline counters have all completed the withdrawal of counters, and WeChat Mini Program mall will be closed in mid-March. Other platforms will not be affected."

△HERA WeChat Mall customer service reply

Obviously, the HERA brand is not withdrawing from the Chinese market, but is selectively focusing online.

In this regard, Amorepacific China replied to the CBO reporter, "Due to the adjustment of business channels and strategic development, the HERA WeChat mall will be closed on March 25, and consumers can still purchase through the HERA Tmall flagship store."

A former Amorepacific employee revealed: "The withdrawal of the HERA counters is related to the structural adjustment carried out by the Amorepacific Group in 2020."

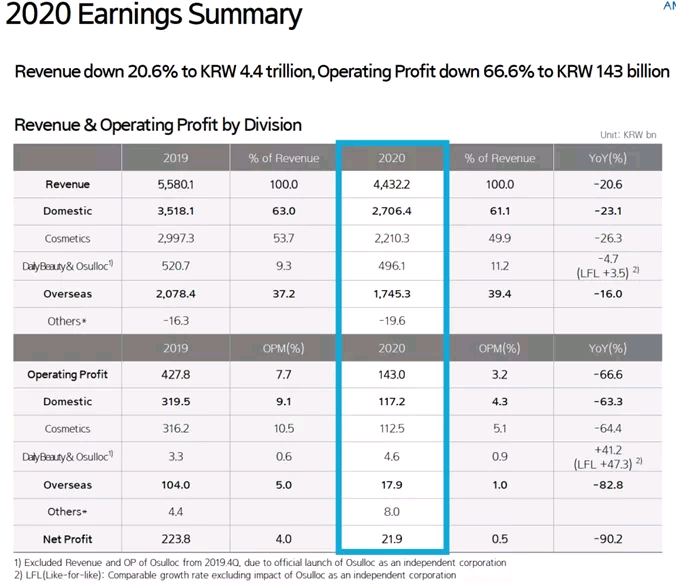

The outbreak of the epidemic in early 2020 caused a huge impact on offline channels, and Amorepacific Group was not spared.

According to the financial report of the second quarter of 2020, the Group's turnover fell by 24.7% to 1.2 trillion Korean won (about 7 billion yuan) and operating profit fell by 67.2% to 36.2 billion Korean won (about 210 million yuan).

△Amorepacific 2020 financial report

In China, due to the substantial online growth of high-end brands such as Sulwhasoo, Amorepacific has increased its investment in e-commerce business of multiple brands. At the same time, Amorepacific has also reorganized the department store channels of IOPE and Mamonde, and continued to adjust the offline stores of Innisfree and ETUDE HOUSE.

△HERA’s First Counter in China in Beijing SKP

In 2016, HERA officially entered the Chinese market by opening a counter in Beijing SKP. Due to the high-end positioning of Beijing SKP, not many department store counters moved in there. HERA’s withdrawal of counters was quiet.

According to the discussion on the Little Red Book, HERA's counter in Zhengzhou had been having 50% off sales since March 2020. Tianjin counters began the process in June 2020. The only counter in Chongqing was withdrawn in August 2020. Hangzhou counter operated until September 2020, and the last counter in Shanghai was closed in October 2020.

△Last counter in Shanghai, Source: Little Red Book

02

The Hallyu (Korean Wave) Wave Ebbs,

Sister Brands Have Different Fates

A general environment that cannot be ignored is that the Korean makeup trend has become a thing of the past in the Chinese market.

At the beginning of 2022, Innisfree, a beauty brand owned by the Amorepacific Group, was rumored to have "retreated" from the Chinese market – the store withdrawal rate exceeded 80%. Etude House, another beauty brand, completely closed all offline stores in the Chinese market in March 2021.

△ARITAUM

Aritaum, a multi-brand collection store owned by Amorepacific Group, has quietly settled in Shanghai Siji Fang in Point since the beginning of 2020. It "closed in October", only surviving for 10 months.

When the news of the withdrawal of multiple brands came out, Amorepacific Group responded, "In the future in the Chinese market, the Group will focus on the mid-high-end and online fields." ”

It is reported that Amorepacific, which has been working in the Chinese market for nearly 30 years, currently has 12 major brands (high,mid,low end) in the Chinese market: including LANEIGE - introduced in 2002, Mamonde - introduced in 2005, Sulwhasoo - introduced in 2011, Innisfree - introduced in 2012, ETUDE HOUSE -introduced in 2013, IOPE and Ryo - introduced in 2015, HERA - introduced in 2016, misery en scene - in 2018, primera - in 2019, espoir (makeup) - introduced in January 2020, and BE READY (makeup) - in April 2020.

What fate will the other brands face?

At the 2022 year opening meeting, Amorepacific Chairman & CEO Suh Kyung-bae said "The company is planning to deepen its digital transformation as a way to attract millennial and Gen Z consumers.”. He emphasized the need to restructure business to move forward.

△Primera

It is worth noting that the VIP group led by the HERA official public account has been converted into the official community of Amorepacific's sister brand Primera. In the group, there is a Primera products price spike promotion going on for the members. It is reported that Primera positions as high-end skin care, focusing on naturalistic seed fermentation, which is roughly equivalent to the high-end version of Innisfree. Primera is obviously one of the main brands of Amorepacific.

It is certain that the Sulwhasoo brand will also continue to keep going.

According to Amorepacific's 2021 financial report, Sulwhasoo's high-end camp is the backbone of Amorepacific's recent growth. In Asia, which is mainly driven by the Chinese market, Sulwhasoo contributed to the main performance, with sales that increased by 50%.

"Korean makeup is actually like this in China. In the past, when many Chinese did not know about Amorepacific, Sulwhasoo had already entered Department Stores in China. When many Chinese only knew about LG home appliances, LG had already opened department stores in China. Sulwhasoo is a high-end brand and still has a good competitiveness.” The above-mentioned person said.