- 2021-10-18

- 阅读量:3670

- 来源| Cosmetic Business Online

- 作者|Zhang Huiyuan

China's beauty market is extremely volatile. Challenges come from all directions. Having been building momentum for 5 years, beauty giant Coty is resolutely looking at a single direction--Making Changes.

On August 26, Coty Inc. announced financial results for the fourth quarter and full year of fiscal year 2021 (from July 1, 2020 to June 30, 2021).

Only one year after becoming Coty China Managing Director, Guilhem Souche scored good marks in his first final exam. During an exclusive interview with CBO, he used the word "Transformation" to summarize the accomplishments of Coty China in fiscal year 2021.

In terms of numbers, Coty achieved two-digit growth in the China market, not only better than fiscal year 2020, but also above the fiscal year 2019 level before the pandemic. Specifically, its Q4 growth speed was 4 times faster than market average; in terms of brands, its matrix of prestige + mass fragrance, make-up and skincare brands was improving, brand exposure was increasing, and market share was constantly expanding; in terms of channels, Coty was moving ahead both online and offline, and its entire fragrance e-commerce business grew 3 times YoY in fiscal year 2021...

In 2016, Coty China began to transform from wholesale model to retail and DTC in prestige. Since then, the fragrance and beauty giant with a history of over one hundred years has been reshaping channels and reshuffling brands in the China market with the gesture of a new player one step at a time.

After 117 years of global operations and 5 years of transforming in China, Coty began to rattle its saber in 2021.

Coty China Managing Director Guilhem Souche

01

Coty not just wants to be No.1 in fragrance

Its strong brand matrixbrandportfolio has taken shape, and the company is working on multiple fronts including fragrance, skincare and makeup at the same time

Founded in Paris, France in 1904, Coty is now one of the largest beauty companies in the world with products covering multiple categories such as fragrance, makeup, skincare, and body care. Specifically, Coty is not only the world's No.1 fragrance company-- -5 of the world's top 20 fragrance brands belong to Coty, but also the world's No.43 makeup company.

In the China market, the fragrance brands of Coty are still in a very dominating position as always.

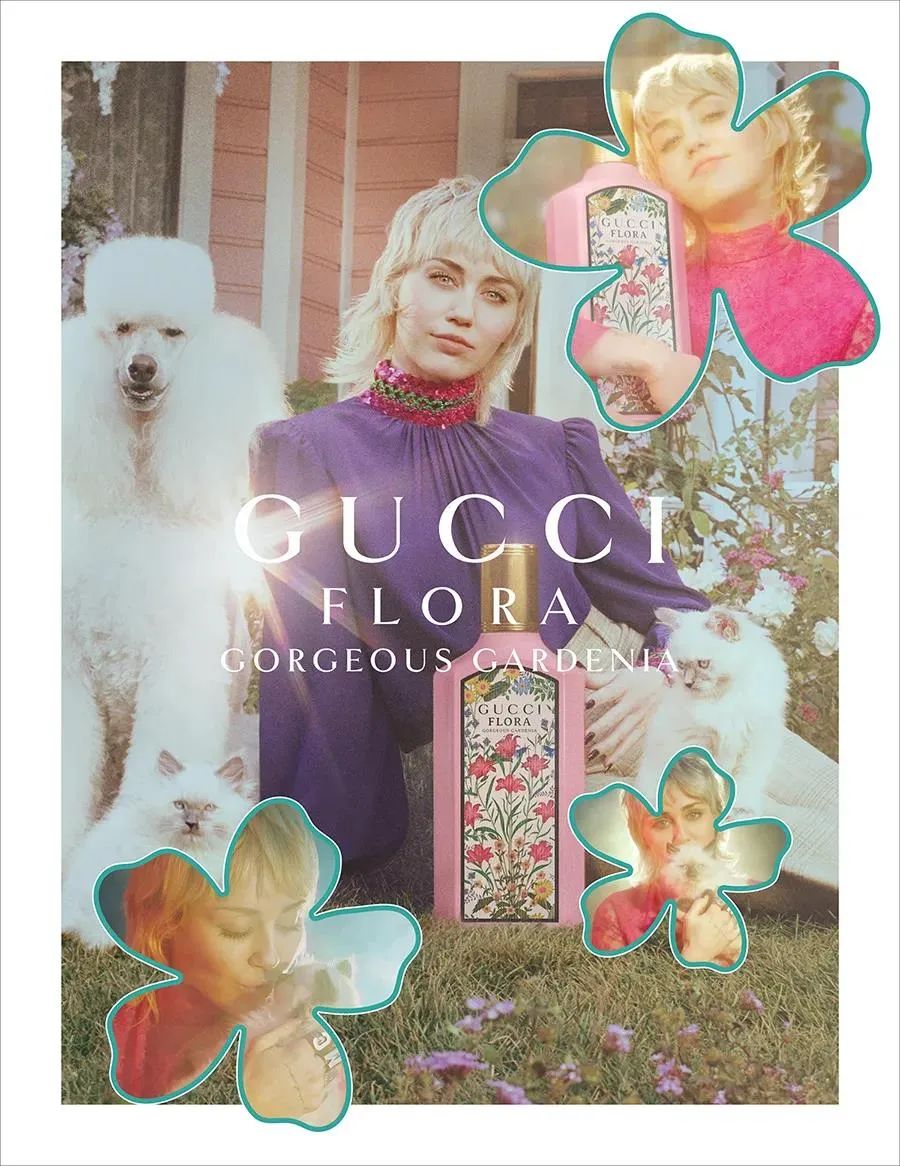

In the past year, the prestige fragrance brands represented by Gucci, the niche fragrance brands represented by Chloé Atelier des Fleurs, and the fragrance brands for men represented by Burberry Hero were the three growth drivers for the fragrance business of Coty.

Gucci Fragrance

There is even better news in specific market segments. For example, Burberry Hero mentioned above became one of the top 3 best-selling fragrance brands for men on Tmall during this past Chinese Valentine’s Day another example is that although niche fragrance brands don't have a big market share yet, they are growing very fast--this category achieved three-digit growth in fiscal year 2021; and finally, with the improving health and sportsawareness of Chinese consumers and their still high enthusiasm for the Olympics, sports fragrance products and sports personal care products led by adidas have also ushered in an opportunity for growth.

Currently, in China's premium fragrance market, Coty has a 12% market share. Souche told CBO that China's entire fragrance market grew 80% during the last quarter, whereas Coty grew 120%.

Apart from fragrance, skincare and makeup are also categories where Coty is gearing up.

In China, sales of the skincare category take a share of over 50%, and Souche is very clear about the importance of the skincare category to Coty. Currently, Coty's skincare brands include the scientific skincare brand Lancaster and the clean beauty brand Philosophy.

Gucci Makeup

Starting from May, Coty has opened three Lancaster flagship stores in Hainan. Apart from meeting consumers via the duty-free channel of Hainan, Coty is upgrading the Lancaster brand across the board, to advance it from the last hot sunscreen product to a level where its brand value and entire lineup of products are well-known to consumers, whereas edgy skincaretechnology will become a keyword for Lancaster to win in the future.

Overseas, clean beauty is now very hot, and Philosophy is one of the leading brands for this. Currently, Philosophy mainly sells through cross-border e-commerce. Through this brand, Coty hopes to take note of Chinese consumers' preference for natural and sustainable products.

Finally, for the makeup segment, Coty not only has the pioneering makeup brand Max Factor, but also has Gucci and Burberry, which have already successfully transformed themselves from having the fragrance category only to having both the fragrance and the makeup categories.

Over this past year, Coty has opened the makeup and fragrance 2-axis flagship stores for both Gucci and Burberry. Both brands achieved two-digit growth or growth in the high teens during fiscal year 2021. With new products from fragrance to lipsticks and the newly launched air cushion compact, Gucci Makeup has become one of the top 20 makeup brands just two years after it was launched.

Gucci Makeup

02

Transforming from wholesale-retail to DTC

Coty is opening offline stores and moving ahead like crazy on online platforms including Tmall/JD/TikTok

Around 2016, Coty was taking frequent moves.

Overseas, Coty acquired dozens of beauty and personal care brands from consumer goods giant P&G and Brazilian consumer chemicals giant Hypermarcas, and also acquired the production and distribution agentship from Burberry for GBP 130 million.

In China, Coty China first took back the nationwide license for dozens of fragrance brands including Marc Jacobs, Calvin Klein, and Chloé from ADE China, a company based in Beijing, and then took back control in China for brands including Max Factor, Bourjois, and Gucci from Eternal.

When the right to operate a brand is firmly controlled by the brand itself, the sales and feedback routes from the group to consumers will be shortened, and Coty will have a bigger chance to communicate with consumers. For Coty, the opportunity for DTC (Direct To Customer) has come.

As such, Coty was hurrying up to open flagship stores for its brands offline, especially for three leading brands: Gucci, Burberry, and Chloé. It is said that during this past year 15 stores have been opened for Gucci, which has entered 6 new provinces and 87new cities. At the same time, driven by the Atelier des Fleurs collection, Chloé will open two fragranceflagship stores soon within the ShanghaiDaimaru Department Store and Beijing Joy City.

Some brands

Online, Coty jumped at the opportunity brought by online traffic, to open stores where theconsumers are. For example, apart from opening flagship stores on Tmall one after another, Coty also opened a fragrance flagship store for Calvin Klein, which is a widely recognized brand but with mid-range prices, on JD, targeting male customers.

In June, Max Factor opened a store on TikTok. It's the first brand of the group to give TikTok a try. Souche believes that TikTok enjoys an extremely big leading edge when it comes to communicating with young people. Max Factor as a leading makeup brand of the group is characterized by being young and accessible to general consumers with exportable content, and can resonate very well with the young people on TikTok.

It's worth noting that on August 23 Coty entered into a strategic partnership with Shanghai Lily & Beauty Cosmetics Co., Ltd., to let the latter operate 4 brands of it: Burberry, Marc Jacobs, Max Factor, and Philosophy. Lily said that the sales of the Max Factor store on TikTok in July grew 1424%LFL, and the cumulative number of viewers watching the live streams was over 110,000.

A live stream of the Max Factor store on TikTok

Souche said: "Today, all the social media platforms are diversifying, and we'll make the corresponding adjustments along with the development of those platforms. Both online and offline platforms are channels to acquire customers. The task of online platforms is to maintain brand image on the one hand and engaging consumerson the other. Therefore, apart from directly opening flagship stores on Tmall, we'll also choose a smaller number of better partners to build more solid relationships with them, so as to better control our brand image."

Currently, for Coty China, e-commerce accounts for about 25% of totalbusiness. Souche disclosed that the ideal percentage of Coty China's online business should be 40% in the future.

03

10 brands will debut at the CIIE

Coty continues to drive investments and development in the China market

Coty will debut at the forthcoming 4th China International Import Expo (CIIE), which will be an international stage for the group.

Coty will bring 10 brands including Gucci, Burberry, Chloé, Miu Miu, Bottega Veneta, Calvin Klein, Marc Jacobs, Lancaster, Max Factor, and adidas to the CIIE. Its 264-square-meter booth is designed to demonstrate the "Beauty That Lasts" philosophy...Coty no longer maintains a low profile.

The PR photo of Coty for the CIIE

Coty CEO Sue Y. Nabi said: " The Chinese market has a particular significance to Coty.We are looking forward to leveraging the great platform provided by the CIIE to showcase Coty’s beauty experience for Chinese consumers, especially in skincare. We look forward to displaying our know-how in sun and anti-pollution protection, vectorization of dermatological grade actives, and the science of long wear behind our prestige makeup or fragrances.

Why did Coty choose to have its CIIE debut this year, the fourth year of the expo?

Souche told CBO: "The biggest purpose of this trip is to let the entire group make an appearance, to let consumers get to know the Coty Group."

Souche believes that thegrowth after Coty's entry into China has been benefited to China's economic boom and the continuous improvement of the business environment. CIIE has highlighted China's ever-expanding global vision of overcoming the epidemic's impact. It has provided international companies with powerful assurances to continue expanding their presence in the Chinese market.

Nabi outlined the 6 strategic priorities for Coty in April, and one of them is "expanding in China through Prestige and select Consumer Beauty brands". The other 5 strategic priorities are respectively: stabilization of Consumer Beauty make-up brands and Mass fragrances; acceleration of luxury fragrances and establishing Coty as a key player in Prestige make-up; building a Skincare portfolio across Prestige and Mass divisions; enhancing e-commerce and Direct-to-Consumer (DTC) capabilities; and establishing Coty as an industry leader in sustainability.

In 2021, let Chinese consumers get to know Coty, and let the China market contribute to Coty's success.

The reporter's note:

French man Guilhem Souche smells of cologne from the latest Hero collection of Burberry, and speaks English with a light French accent.

He is really in a pickle, but is also very vibrant.

Having been in this industry for 25 years, he worked for L'Oréal S.A. and Dior in the past, and was instrumental behind multiple iconic products including the very hot "Little Black Bottle" of Lancôme. He has been in China for 12 years, is very familiar with Chinese culture, and is very good at using WeChat emojis.

He is a go-getter who likes to visit consumers in the field to learn about the new developments, likes to chat with business partners about the new needs of consumers, and can skillfully use the translation feature of WeChat to get industry knowledge. He is also an observer who likes to observe China's post-00s through his own three kids, and also knows what's on trend for young people on Shanghai's Wukang Road and Anfu Road.

To the company's employees, he is "a man who is absolutely able to catch up with the trend."

He keeps a watch on the brands emerging in China during recent years, and believes that these brands bear extremely powerful social media DNA, and Coty should learn from them in terms of their innovation speed on various fronts as well as their flexibility in capturing what's on trend. But he also dialectically believes that it takes time to observe these brands for long-term performance and from the perspective of sustainability.

Souche said: "When it comes to transformation, there isn't a day that it will be over. The market is changing, so at Coty, change is a constant."

It seems that, after 5 years of painstaking adjustment, Coty is ready to keep the momentum going and embrace the year for change with the best condition and the biggest confidence.