- 来源| Cosmetic Business Online

- 作者|Li Jian Zi

If Byredo, with its own brand following, is really acquired by L’Oréal Group it will be another big deal for L’Oréal in the Chinese market.

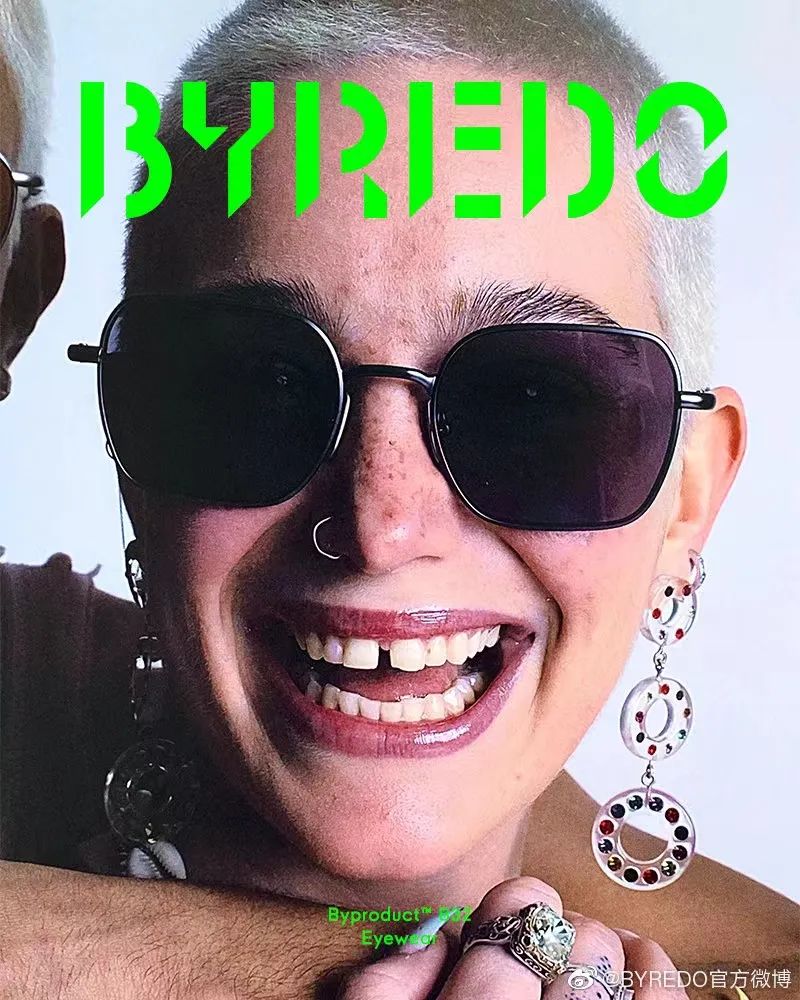

Recently, according to the French newspaper Le Figaro, L’Oréal Group is expanding its luxury perfume brand portfolio by finalizing the acquisition of Sweden's top luxury fragrance brand Byredo, which is supported by British fund Manzanita Capital, the owner of Diptyque. The amount of the transaction has not been disclosed, but the transaction will be based on a valuation of 1 billion euros (about 7.107 billion yuan).L’Oréal China did not explicitly deny the news, and replied to the “Cosmetics Business Online (CBO)” reporter that everything is subject to the official release.As soon as the news came out a number of domestic department store personnel in charge expressed to the “Cosmetics Business Online (CBO)” reporter that they look forward to L’Oréal’s proposed acquisition of Byredo. “Byredo is more discerning than Diptyque, and joining L’Oréal may make it easier to move into department stores.” Some department store personnel said.In November 2019, Byredo opened its first boutique in Shanghai in the Chinese mainland market, followed by additional stores in Shanghai, Beijing, Shenzhen, Chengdu and other places. Today, In addition to being a popular star in shopping malls and department stores, Byredo has also entered HARMAY. Behind Byredo’s accelerated expansion in the Chinese market is the confidence of Byredo, a Swedish fragrance brand, which has been recommended by a large number of consumers on Chinese social platforms.The "outsider" led through the door by perfume master Pierre WulffBorn in Stockholm, Sweden to a Canadian father and an Indian mother, Ben Gorham grew up in Cities such as Toronto, New York and Stockholm before immigrating to Canada at the age of 12.With medium long hair combed into a neat ponytail, a beard, and arms covered in tattoos, Gorham looks very "artistic" and very much like a "poet". In his 20’s Gorham was a professional basketball player with a height of 1.92 meters and a momentum for his dreams. Gorham ended his basketball career at the age of 26 and returned to Sweden to study at art school in Stockholm. After trying out sculpture, photography, history and many other fields, he finally decided to specialize in fine arts, and successfully graduated with a degree in painting art.At that time, as an "outsider", Gorham had not imagined that he would be in the world of fragrance in the future, until he met Pierre Wulff, a perfume master who changed the trajectory of his life.Gorham had heard about Pierre Wulff while in Sweden. By chance, the two met at the Wulff’s perfume laboratory, and Wulff’s collection of raw materials opened Gorham's eyes. During their conversation Gorham found it difficult to express the desired aroma in the literary and artistic vocabulary he had learned, but Pierre was always able to accurately describe the smell he imagined, and encouraged: “The perfume is actually very simple, you can also try it.”This meeting made Gorham decide to shift his focus from painting to perfume making. Without formal perfume training, Gorham invited perfumers Olivia Giacobetti (perfumer for Diptyque’s signature Philosykos) and Jerome Epinette (perfumer at atelier cologne) to help him realize his vision. In Stockholm in 2006 the 31-year-old “layman” with no industry experience boldly founded his own brand, Byredo.The clean lines of Byredo’s packaging also bring a unique modern feel to this "rising star" perfume house. Originating in Scandinavia and with inspirations from around the globe, Byredo captured the hearts of many perfume lovers. Packaged in a simple cylindrical glass bottle with white labels and a black dome-shaped cap, it is designed to translate very specific personal memories into smells.The year after the brand’s founding Byredo entered Barneys New York, an American luxury department store, becoming the second-best-selling perfume brand the following year. In 2013 Byredo launched hand care products. In 2017 the brand launched a series of luxury leather goods, handbags, and has since expanded its product range to include leather goods.In 2020 Byredo launched a makeup collection. In March of this year Lucia Pica, Chanel's former Makeup Director, joined Byredo as the new Creative Image and Makeup Partner. In April of this year Byredo launched fragrance shower gel and body lotion, taking another step in the expansion of the sub-category.Since the end of 2019 Byredo has opened boutiques in Shanghai, Beijing and Shenzhen. In 2021 Byredo officially opened the Tmall flagship store, and changed its Chinese name from百瑞德(known to consumers) to the new name柏芮朵.Creating a "new version" of luxury?Though Gorham never intended to start a fashion brand, it now seems reasonable to venture into the category of accessories. After all, the brand's revenue in the UK has grown at a double-digit rate every year since 2013.“I think a woman’s handbag possesses a sense of intimacy is very similar to the intimacy they feel about perfumes.” He explained, “A lot of women carry one handbag but change clothes every day – so fashion is the rotating part of their identity and expression, but the handbag remains the same. Our idea of Byredo has always been to spend a long time to make near-perfect items that people can ‘wear’ for a long time. That’s why I want it set apart from fashion as an industry.”“Luxury is not inclusive. I remember the first time I walked into a Hermès store in Paris people stared at me like I didn't belong there. However, when I started my business I had similar ideals to luxury brands in some places, such as slow growth and high-quality craftsmanship. I feel that Byredo can be a ‘new version’ of luxury. It’s different from the concept that people used to accept. With Byredo I wanted a more inclusive approach to luxury and that’s what I have to work hard for.” Gorham said.As early as the end of 2014, Byredo has launched a series of leather accessories to test the waters. In 2019 Gorham launched a new product line, ByProduct, to house his non-olfactory creations. The line produces suits, sneakers, eyewear, wallets, jeans and household items. In addition, Gorham has recently partnered with several brands to develop non-Byredo products, including a range of affordable candles with IKEA, adventure gear with Peak Performance, a table with La Manufacture, and a range of surf-inspired clothing with Stockholm (Surfboard).Today, from a well-known niche fragrance brand, Byredo has already silently broken the industry's conventions and quickly expanded to a broader luxury world such as glasses, leather goods, shoes, clothing and other categories. Currently, the brand's leather goods are all produced in Italy, using French calf leather, lizard leather and python leather, and the price ranges from $1,000 USD to $3,200 USD.“I don’t think the concept of luxury has a definition, but I think if you continue to produce quality goods within the scope of the products you create, it will give people different contact points, allowing people to develop personal relationships with your brand and reach a certain scale.” Gorham said.L'Oréal is interested in the fragrance category and, more importantly, the Chinese market that Byredo is in. At the Group’s 2021 earnings meeting L’Oréal attributed the boom in luxury fragrance to Chinese consumers and expects it to continue to grow at double-digit rates in the coming years. Cyril Chapuy, President of L’Oréal’s Luxe Division, highlighted the extraordinary success of the company's luxury fragrances over the past year.“Historically, fragrance have been a small category in China, less than 5% of the Chinese luxury market, but it is growing very fast. In the last month of 2021, fragrance’s share of the Chinese luxury market is close to 10%. New generation of Chinese consumers has discovered perfumes and love the experience.” Chapuy said.While targeting the fragrance market as the new growth space, L’Oréal is constantly adjusting its brand matrix.On the one hand, L’Oréal continues to occupy the commercial fragrance highlands of the Chinese market with licensed beauty line fragrance products from luxury brands such as YSL, Armani, Valentino, Maison Margiela, and so on. On the other hand, L’Oréal still lacks a strong high-end niche fragrance brand in the Chinese market. Meanwhile, the Estée Lauder Group has already planned out KILIAN and Editions de Parfums Frederic Malle in the Chinese market.Following the closing down of Roger & Gallet stores in China in mid-2020, L'Oréal reported in mid-March this year that it intends to withdraw Atelier Cologne from North America. L'Oréal China once told Cosmetics Business Online (CBO) that Atelier Cologne's adjustment is unrelated to the Chinese market. However, it is undeniable that as a niche fragrance brand that officially landed on the Chinese mainland market in 2017, less than a year after being acquired by L'Oréal Group, Atelier Cologne did not bring enough good surprises to L'Oréal Group and Chinese consumers.Data shows that in the second quarter of 2021 the number of neutral niche fragrance merchants in China was 3035, an increase of 53.75% year over year. In the field of niche fragrance it has always been those few brands that have won the hearts of the consumers. On the one hand, Estée Lauder, Shiseido, Coty, Puig and other groups have been continuously claiming market shares in Chinese market with their high-end and niche fragrance brands. On the other hand, Chinese local high-end fragrance brands such as DOCUMENTS and SYNESMOON have emerged.Faced with a stormy new competition track, L’Oréal needed a strong player like Byredo to quickly start to compete in the field. One person in charge of a TOP5 domestic shopping center told the “Cosmetics Business Online (CBO)” reporter, “At present, Byredo’s monthly performance in the store has reached 1.5 million RMB, which is not bad.”The UK based private equity firm Manzanita Capital currently owns majority stake of Byredo. Manzanita Capital was founded in 2001 by William Fisher, the second son of Donald Fisher and Doris F. Fisher, the Founder of the famous American clothing group GAP. Manzanita Capital focuses on “niche treasure brands” in the beauty sector, acquiring brands such as Diptyque and Kevyn Aucoin Beauty, in addition to Byredo. Its investment projects include British beauty retailer Space NK, British high-end skincare brand Eve Lom (now acquired by Perfect Diary's parent company Yatsen Holding E-commerce), and American Internet beauty company Glossier.Meanwhile, in May 2021 L’Oréal confirmed that Nicolas Hieronimus is to become the group’s new CEO. L’Oréal reported sales reached 32.28 billion euros in 2021. Notably, if the deal is completed, it will also be the first acquisition made by Nicolas Hieronimus as CEO.