- 2021-11-11

- 阅读量:3780

- 来源| Cosmetic Business Online

- 作者|

the report was compiled by 13 journalists who spent 100 days visiting 108 cosmetics brands, production enterprises and raw material companies in Guangdong.

There are not only famous cosmetics brands gathered in Guangdong, China, but also professional manufacturers, such as NOX BELLCOW, BEIHAO, WANYING, MONBON, BAWEI, QIANCAI, SANJIAO, RUNJIE, EASYCARE, and BRUNDO, as well as Bo De Biotech Innovation Research Department focusing on R&D, Global Cosmetics Innovation Lab, and Quanzhi Skin Biotechnology Research Institute. Furthermore, there are also raw materials and packaging materials suppliers like LIJI PACKAGING, WINCOM, FENHAO, LIHUA, TINCI, YESER, FLYCO and HYACINTH PAPER established in Guangdong.

According to the latest data from the National Medical Products Administration Institute, there are 5,108 cosmetic production enterprises in China, of which 3,108 are in Guangdong. At present, the number of cosmetics enterprises in Guangdong is about 500,000, accounting for nearly 70% of the total number of products in China.

Since 15 July, 2021, Cosmetics News, Cosmetics Business Online and AESTHETICISM ARTISANS, in conjunction with the Guangdong Chamber of Daily Used Chemicals have conducted field research and visited 108 cosmetic brands, production and raw material enterprises in Guangdong, including LIBY, LOVEFUN, MARUBI, CARSLAN, YALGET, YSG, NOX BELLCOW, WANYING and MONBON; meanwhile, they have written and published 103 articles and obtained nearly 100 survey samples. The following is the text of the report, which aims to uncover authentic business stories and reveal the most realistic production status and competition pattern of cosmetics industries and enterprises in Guangdong.

I. Overview of cosmetics industries and enterprises in Guangdong

Keywords: total output value, heritage and talent, supply chain advantages and business environment

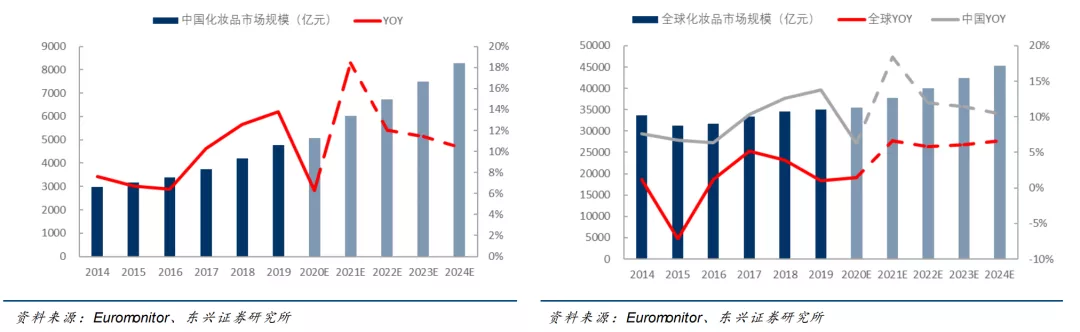

1. The total output value accounts for half of the country

According to the data of the National Bureau of Statistics, the total retail sales of cosmetics in China reached RMB 340 billion in 2020, increased by 9.5% on a year over year basis (for goods above the quota).As early as 2019, the annual output value of cosmetics in Guangdong has exceeded RMB 210 billion. As well, according to the data from the National Medical Products Administration, there are 5,108 cosmetic production enterprises in China, of which 3,108 are in Guangdong.

Scale of Cosmetics Market in China

In terms of distribution area, 56% of the enterprises surveyed are headquartered in Guangzhou and 18% are from Shantou. Also according to the data from the National Medical Products Administration, as of the end of last year, the number of enterprises that had obtained the Cosmetics Production License was 1,937 in Guangzhou, 269 in Shantou and the rest in Foshan, Shenzhen and Zhuhai.

Top5 Prefecture-level Cities in the Number of Production Enterprises

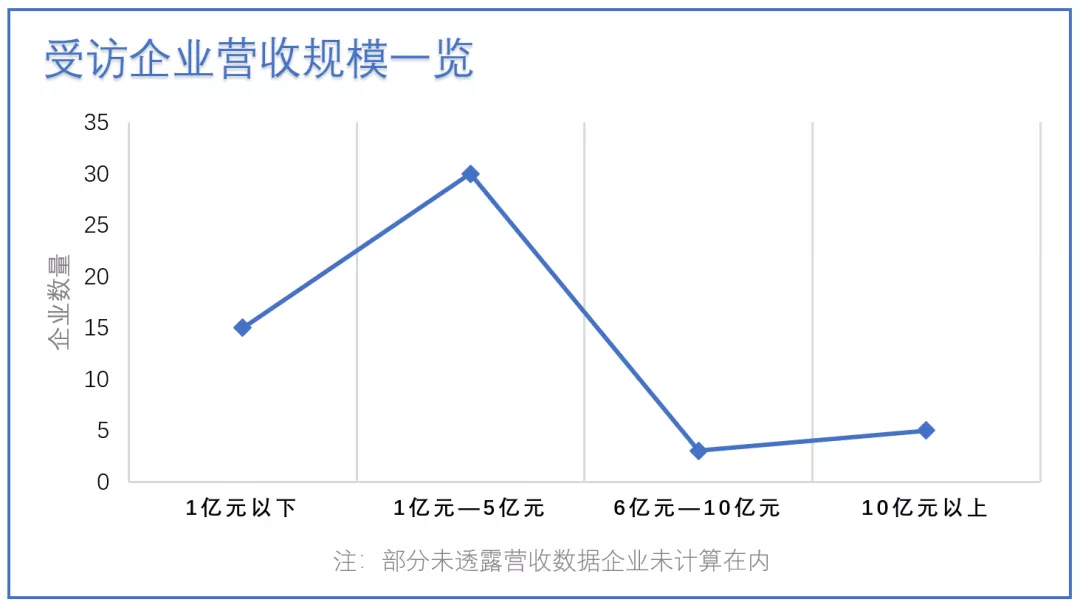

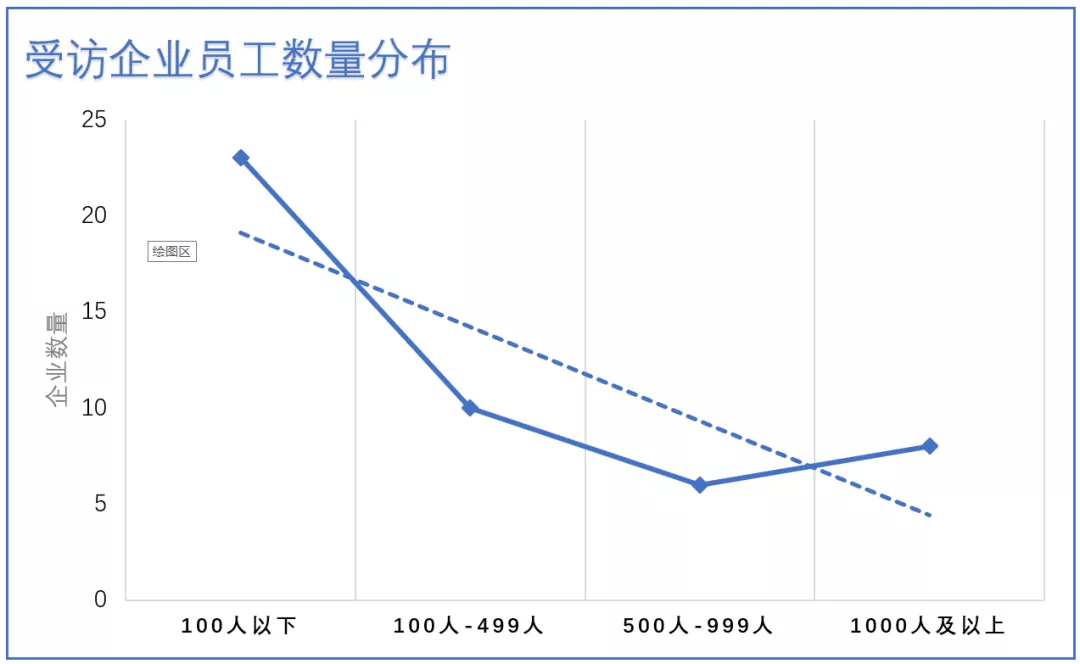

In terms of revenue scale, 10% of enterprises surveyed have revenue of more than RMB 1 billion, and more than 30% have annual revenue of less than RMB 100 million. Nearly 60% of the enterprises have annual revenue of RMB 100 - 500 million.

Top5 Prefecture-level Cities in the Number of Production Enterprises

In terms of revenue scale, 10% of enterprises surveyed have revenue of more than RMB 1 billion, and more than 30% have annual revenue of less than RMB 100 million. Nearly 60% of the enterprises have annual revenue of RMB 100 - 500 million.

Number of Employees

2. The industrial heritage is deep and attracts talent

In the 1980s the first joint venture in China was established in Guangzhou by the global giant P&G. With the joint venture factory as the center of radiation, enterprises covering the entire upstream supply chain of the cosmetics industry were gradually gathered in Guangdong, including raw materials and packaging materials enterprises.

In addition, P&G has also provided many talents in cosmetics industry to Guangdong and even China. Today the P&G entrepreneurs, who are known for their keen market insight and marketing style, have created cosmetics brands in Guangdong, including PERFECT DIARY, SIMPCARE,NATTITUDE, HFP, etc.Thirty one percent (31%) of enterprises surveyed were established in the last century. After an economic cycle spanning more than two decades, the baton was gradually passed from the "founders" to the "successors" of enterprises, such as LIBY, MINGCHEN, BAWANG, GN PEARL and LCHEAR.

3. The advantage of cosmetics supply chain in Guangdong is not only the cost advantage, but also a strong ecosystem

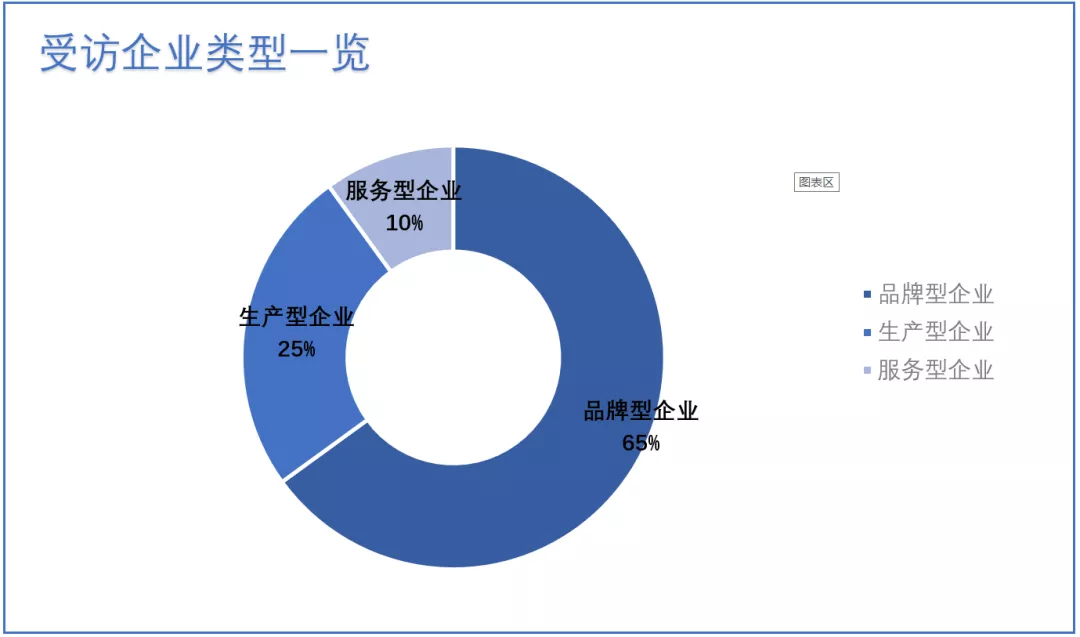

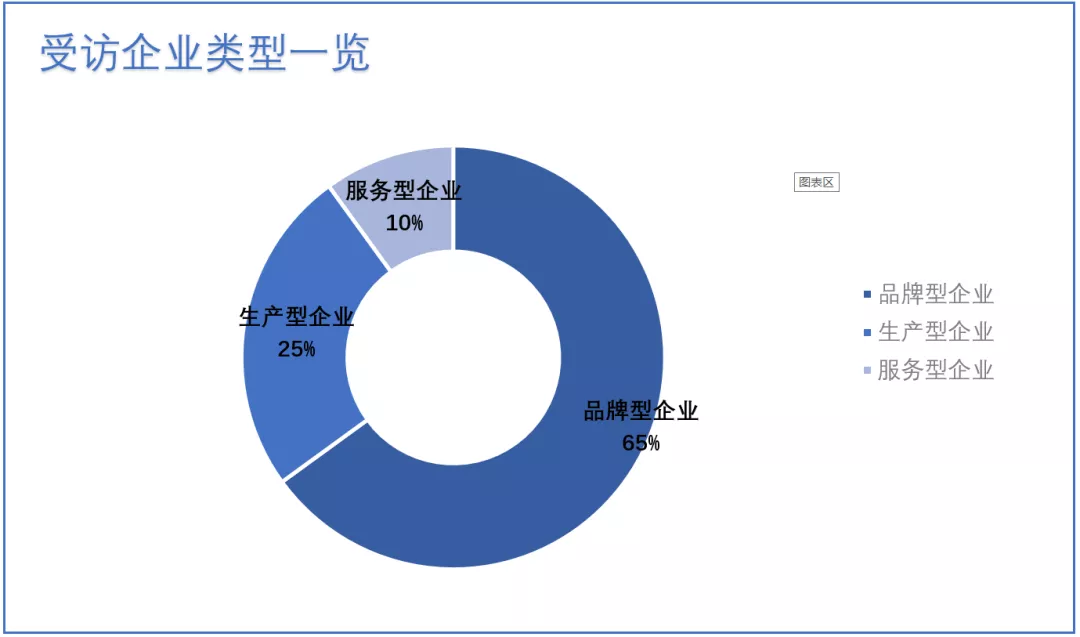

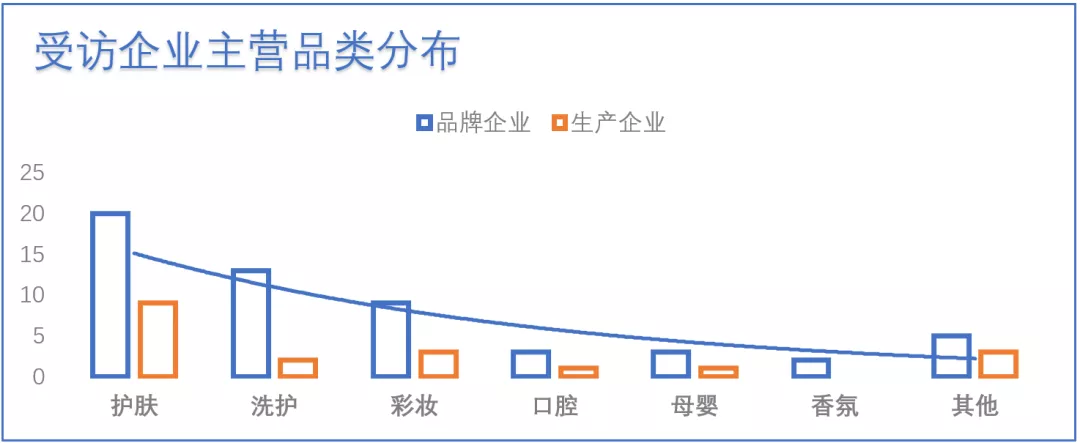

Generally, the cosmetics industry chain includes raw material packaging, R&D and production, brand, distribution/distributor operation and terminal retail. Considering the primary business activities, among the cosmetics enterprises interviewed, there are 65 brand enterprises, 25 production enterprises and 10 service enterprises.

The supply chain advantage of Guangdong cosmetics is not only cost advantage, but also a strong ecosystem, from materials to cartons, bottle caps, pump heads, and then to design, R&D, production, testing and marketing planning, the brand entrepreneurs can quickly find the one-stop solution for their products before these products hit on the market. The mature supply chain not only provides strong support to cosmetics enterprises in Guangdong, it also gives agglomeration benefits to cosmetics enterprises in Jiangxi, Hubei and other areas;e.g., Brands outside of Guangdong province such as SNEFE, SAKOSE have cooperated with Guangdong OEM factories or set up local R&D centers.

4. Industry cluster effect is highlighted

Thanks to the development dividend provided by the reform and opening up and the excellent business environment in Guangdong, the Guangdong cosmetics industry has made a great progress since 1980, both in quantity and quality.

In January this year, the Implementation Plan for Promoting High-quality Development of Cosmetics Industry in Guangdong Province was issued in Guangdong Province, which mentions that by 2025, Guangdong Provincewill strive to cultivate 3 - 5 leading enterprises with annual sales revenue of over RMB 20 billion and RMB 10 billion, more than 10 local enterprises with annual sales revenue of over RMB 5 billion, and more than 10 well-known national brands; in addition, the market share of local independent brand products will account for more than 50% of the whole country.

Source: the Implementation Plan for Promoting High-quality Development of Cosmetics Industry in Guangdong Province

In Guangzhou, for example, the cosmetic industry has been taken as a key industry in Baiyun District, with hundreds of billions level of regional brands of "Baiyun Beauty Bay” under development.At present, the cosmetic industry accounts for 10% of overall economy of Baiyun District. In Huangpu District where “Southern Beauty Valley” is in the making. P&G, AMWAY, BLUE MOON, MARUBI, UNIASIA TECHNOLOGY and other leading enterprises of daily used chemicals have been gathered, there is registered capital of over RMB 100 million, accounting for over 30% of the total.

II. Competitiveness analysis of cosmetics industries and enterprises in Guangdong

Keywords: gross profit margin, advantage category, SKU, channel structure and customer structure

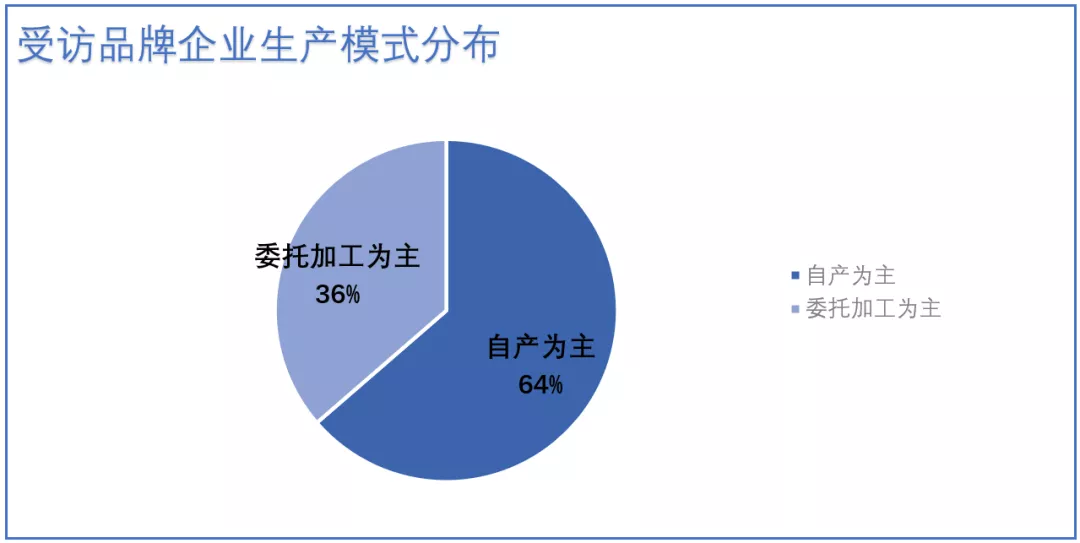

Generally speaking, the core competitiveness indexes of cosmetics production enterprises are different from those of brand enterprises. The core competitiveness of cosmetics OEM enterprises includes:R&D capability, product quality, delivery speed and cost control capability; while the core competitiveness of brand enterprises includes:R&D capability, brand assets and channel network. 64% of the brand enterprises among the surveyed enterprises are mainly self-produced brands, such as BAWANG, DENTAL DOCTOR and CATKIN, and these brands need to have comprehensive capabilities such as supply chain, brand and channel building.

1. The time when the real impact of the epidemic appears is in 2021

In 2020 the revenues of 59% of the enterprises surveyed increased year over year. 32% enterprises declined year over year, and 9% enterprises balanced year over year.Thanks to the increase of the disinfectant product line, the revenue of partial cosmetics enterprises in Guangdong in 2020 is better than that of this year.The time when the real impact of the epidemic appears is in 2021. Under the impact of global trade war and pandemic, the cosmetics enterprises in Guangdong are already feeling the pressure of tightened revenue and profits in the second quarter of this year.

2. The gross profit margin of brand enterprises and production enterprises is 51% and 25%, respectively

Among the surveyed enterprises, the average gross profit margin of brand enterprises is 51%, and that of production enterprises is 25%; the sales expense ratio of brand enterprises is 31% and that of production enterprises is 4%; and the average R&D expense ratio of brand enterprises is 3% and that of production enterprises is 4%.

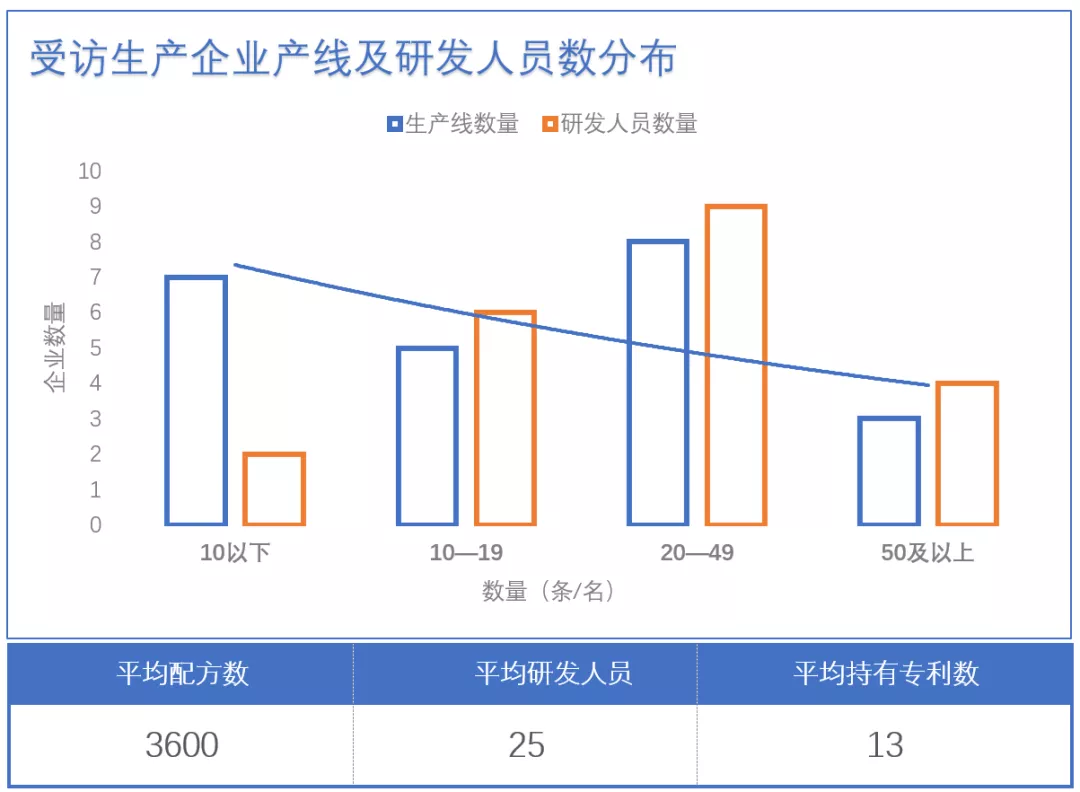

In the R&D area, the R&D expense ratio of surveyed production enterprises is usually above 3%, higher than that of brand enterprises. In addition, the average number of formulations in the surveyed production enterprises is 3,600, with 13 patents and 25 R&D personnel. The number of R&D personnel in over 40% production enterprises is between 20 and 49, and the number of production lines in over 30% production enterprises is between 20 and 49.

3. The washing and care category is in a strong position, and SKU shrinking is a general trend

Among the surveyed brand enterprises, 36% are mainly engaged in skin care, and the washing and care enterprises exceeded the color cosmetics enterprises, which accounted for 23%. From SLEK, REPAND, TRIATOP, LOVEFUN, HOUDY and DIFASO to SEEYOUNG, ADOLPH, NATTITUDE and KUSTIE, up to the present day Guangdong has advantages in washing and care products,making it a banner of China's local shampoo market.

In terms of products, SKUs of over 80% of the surveyed enterprises are less than 500, of which 29% are enterprises with SKUs below 50, and 27% are enterprises with SKUs between 200-499. In response to the current channel pattern, enterprises such as YANOR, GN PEARL and CINGA have turned to the strategy of “revivingthe market with hit products to drive sales of the entire brand”,and shrinking the number of SKU has becoming a general trend.

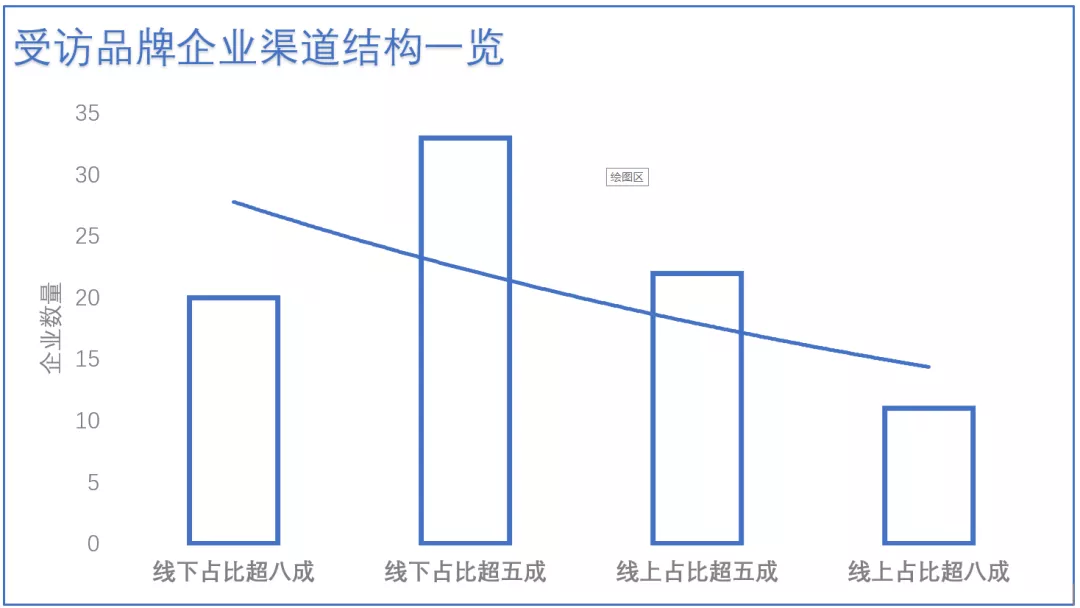

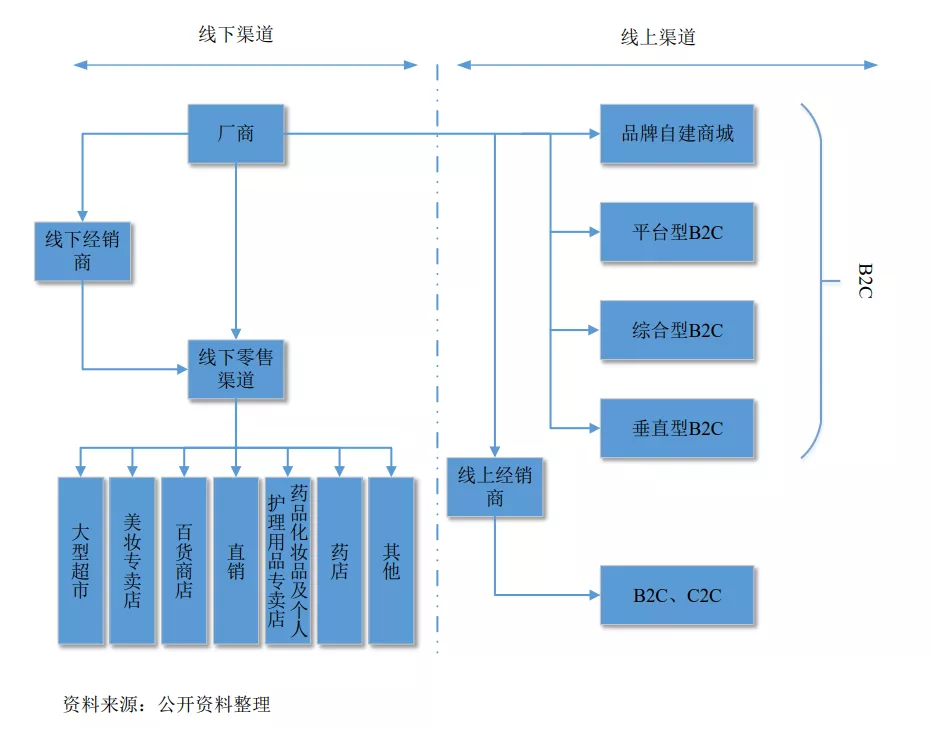

4. Over 30% of enterprises' offline channel revenue accounts for over 80%

Among the surveyed brand enterprises, 56% of the enterprises' offline channel revenue accounted for more than 50% of their entire revenue, and 34% of the enterprises' offline channel revenue accounted for more than 80%. Thirty eight percent (38%) of enterprises' online channel revenue accounts for more than half, and 18% of enterprises' online channel revenue accounts for more than 80%. Overall, the age of the established enterprises is positively correlated with the proportion of offline channel revenue. However, established cosmetics enterprises are also seizing opportunities from new channels, such as livestreaming e-commerce and interest e-commerce.

For example, Guangdong Qiaomeiren Cosmetics Industrial Co., Ltd., founded in 1987, has not only entered new e-commerce platforms such as Douyin, Kwai and Pinduoduo, but also set up self-broadcast studios. In addition, although the sales channels are changing rapidly, the brands rooted in physical channels and intensive cultivation such as MEIFUBAO, YALGET, NATURE TECHNOLOGY and AVVA are still having stable performance.

Image source: prospectus of a listed company

5. More than 60% of manufacturing enterprises have cooperation with cutting-edge brands

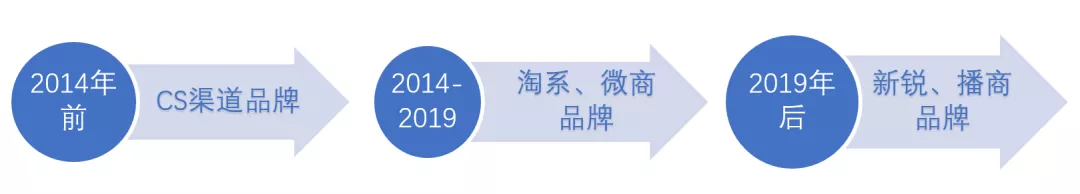

In 2014 e-commerce, Wechat business and direct sales have emerged, leading to sharp rise of orders for OEM enterprises. The change of channels brought big dividends to the cosmetics OEM industry at that time. As a result, OEM enterprises achieving the revenue of RMB 30 million ten years ago were some of the largest factories in the industry, while nowadays OEM factories with the revenue of RMB tens of millions are everywhere.

Incremental customers at different stages of production enterprises

After Wechat business and directsales became popular, OEM enterprises ushered in the second wave of dividend in 2019 -- the rise of cutting-edge brands and the popularity of livestreaming e-commerce. More than 60% of the surveyed production enterprises have established cooperation with cutting-edge brands. In the first half of this year, EASYCARE's revenue increased by more than 50%year over year, and the largest growth segment came from the cooperation with cutting-edge e-commerce brands. In addition, BAWANG has established cooperation with BILSPRING, NYSCPS, PENINSULA and other brands, while BRUNDO had cooperation with PWU, MAKE ESSENSE, SIMPCARE and other brands. In order to meet the rapid promotion needs of cutting-edge brands, these OEMs have specially set up product development teams composed of market business personnel, product managers, technical engineers, raw material engineers and regulatory specialists to serve customers one-to-one.

III. Structural problems hidden under the good numbers

Key words: weak brand power, low price competition, Matthew Effect

There are a large number of cosmetic manufacturers in Guangdong, with obvious industrial advantages and a complete ecological chain. However, there are still structural problems such as unbalanced development, a lack of excellent domestic brands, and insufficient R&D capability. Many enterprises cover up their strategic mistakes with tactical diligence, and their brand premium and profitability are low.

1. Weak brand power and prominent low price competition

At present, imitation, plagiarism and low price competition are still common in the Guangdong cosmetics industry. Taking the facial mask category as an example, there was basically no product less than RMB 8 per piece in 2012, while now products of RMB 9.90 per piece (including delivery) are flooding the current market. As saying goes from some insiders: "Low price competition of facial mask products will only drag on competitors and they will starve themselves.” Another example is the ampoule category. "Nowadays, the low-cost ampoule products flooding the market have extremely low content concentration, and even some have 90% water content.” one of the interviewees said. "A low price at the expense of quality and fake and shoddy goods is tantamount to killing the goose lays the golden egg."

Image source: Hua Chuang Securities

In addition to the category dimension, low-quality competition is also common in emerging channels such as live broadcasting. Livestreaming e-commerce has driven the rapid growth of OEM business. Some OEM enterprises could survive with a single online live broadcasting channel, while some enterprises compete for resources by compressing profits with low prices, which was particularly obvious during the outbreak of the epidemic in 2020.

2. With the implementation of the new regulations, cosmetics enterprises have ushered in a new round of reshuffling

With the Regulation on the Supervision and Administration of Cosmetics officially implemented in January this year and relevant supporting documents successively issued, a new supervision and management system for the cosmetics industry was gradually formed, and both production enterprises and brand enterprises entered an intensive period of law and regulation learning.

Image source: Specification for Evaluation of Cosmetic Efficacy Claims

Efficacy claim and evaluation have become the focus of enterprises under the new regulations. Human efficacy evaluation test must be conducted for 6 efficacy claims including freckle whitening, sunscreen, anti hair loss, acne removal, nourishment and repair according to the "requirements for evaluation items of cosmetic efficacy declaration" in the latest Specification for Evaluation of Cosmetic Efficacy Claims. Among them, the maximum cost of single test can reach RMB 270,000, and the efficacy superposition cost can exceed RMB 300,000.

It is undeniable that the new regulations are accelerating the reshuffle of the industry, and the survival of the fittest is the general trend. On the one hand, OEM factories whose production conditions are not up to standard and cannot afford the cost of specific efficacy claims will be phased out; On the other hand, the advantages on cost and scale of relatively standardized leading production enterprises will be more obvious.

3. Practical problems: rising prices of raw materials, power restriction and epidemic

In September this year, with many provinces beginning to implement the policy of "power rationing", many cosmetics manufacturers issued notices to adjust their production plans. Moreover, in 2021 there were several rounds of price increases of cosmetics raw materials affected by the continuous high oil price and various factors, and consequently many raw material and packaging materials suppliers successively issued price increase notices.

Against multiple backgrounds such as rising raw material prices, power restriction, and the epidemic, on the one hand, production costs will continue to affect the gross profit level of production enterprises, and under the pressure of low gross profit operations, refined management capabilities have become a key capability for enterprises. On the other hand, the high profit era of brand enterprises may end. For the long-term and healthy development of brand assets, brands need to implement conservative business strategies and attach importance to the input-output ratio.

IV. Five trends of cosmetics industries and enterprises in Guangdong

Key words: intelligent manufacturing, raw material R & D, business diversification, DTC, post-90s entrepreneurs

dge enterprises and established enterprises. From low price competition to high-quality development, some cosmetics enterprises in Guangdong are making changes from the source.

1. Refined operation along with intelligent manufacturing

In essence, almost all long-term value is based on the differentiation and efficiency of the supply chain. Based on this production enterprises in Guangdong are moving towards refined operation, increasing intelligent manufacturing, and deeply integrating information and industrialization.

For example, UNIASIA TECHNOLOGY has built an automated integrated central control system. With the online SAP system and MES management and control platform, it has realized the information management of production planning, simulation scheduling, error proof batching, intelligent warehousing, data acquisition, whole process quality traceability, electronic billboard, operation monitoring center, and so on.

EASYCARE has made capacity layout around large-scale personalized private customization and private customization of small groups. Its intelligent production line has unique line-changing technology. Thanks to the accumulated data in the early stage and intelligent manufacturing equipment, a single production line of it can produce diversified products to meet the needs of different consumers, realizing C2M large-scale personalized customization production.

BRUNDO has invited FOXCONN's automation team to design the intelligent scheme of the factory and customize a series of intelligent software and hardware equipment for the factory. BAWEI has covered its new park with 5G, and plans to have AGV (intelligent transporting robot) transportation replace part of the manual handling, and a central scheduling system replace manual instructions; APS intelligent production scheduling is adopted, automatic filling and packaging are adopted in the production process and cooperative robots participate in the process operation.

2. In depth R & D and raw material development

Nowadays, more and more cosmetics enterprises in Guangdong realize that channels, live streaming and share and recommendations are the basic skills that beauty cosmetics enterprises should have, not the core competitiveness of enterprises. The core competitiveness of cosmetics enterprises must be the brand, behind the brand is the product, and behind the product is R & D.

For example, following the completion of the European R & D center in Italy, CARSLAN will establish an Asia Pacific R & D center in Japan next year. This year, Nord Traceability, the parent company of Simpcare, officially reached a strategic cooperation with the Gene Engineering Pharmaceutical National Engineering Research institute in Guangdong to jointly build a joint functional skin care laboratory; Yatsen Holding Limited and the National Engineering Research Center for Nanomedicine of Huazhong University of Science and Technology have jointly built a laboratory. A number of raw materials jointly developed by the laboratory have been applied in products of multiple brands of Yatsen Holding Limited. In addition, Nox Bellcow, DEVA and other production enterprises and brand enterprises began to seek cooperation with raw material suppliers to develop and exclusively supply customized raw materials.

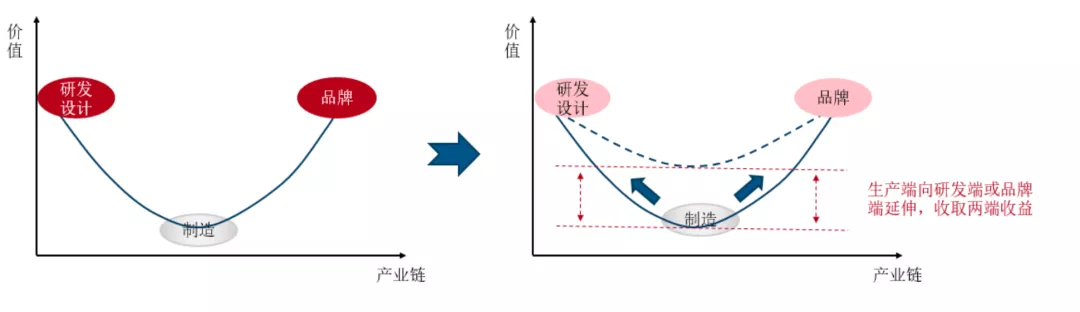

3. Business diversification: Brand does OEM, OEM creates brand

In recent years, the business sources and customer composition of Guangdong brand enterprises and production enterprises have become diversified, and the boundaries between different types of enterprises have become increasingly blurred. For example, some production enterprises began to go downstream and cooperate with Internet celebrity, anchor and MCN institution to create new brands; Brand enterprises such as Bawang and Muzzi release their surplus production capacity by developing OEM business. In addition, some leading enterprises such as LIBY, LOVEFUN and MARUBI also use their own middle and back platform capabilities such as R & D, supply chain and quality control to incubate new brands.

4. Factories and brands face consumers directly

With the improvement of mobile Internet infrastructure, brand enterprises and production enterprises have more ways and opportunities to face consumers. In addition to building a private domain, some brand enterprises began to try to take self-broadcast as brand showcase, and put the roles of beauty guide experts and sales managers at the front, allowing them to have face-to-face conversations with consumers.

It is also crucial for an enterprise to use data to enable product upgrades and iterations after getting the first hand consumption data. For example, for the development of technology, data and related functions, Yatsen Holding Limited has established a team of 239 engineers, which accounts for 18.5% of the total number of employees in the group headquarters.

In DTC mode, the factory is also making efforts. For example, Yalan International new industrial park plans to use AI technology for live broadcasting, establish communication channels with consumers through 5G and AI, establish transparent visit channels, and show the production process in real time through live streaming video, so as to realize the transformation from traditional industrial chain to manufacturer to customer(M to C).

5. Post-90s Cosmetics Entrepreneurs Emerge

In the era of "once the advertisement comes out, there are thousands of gold", the entrepreneurs of the first generation of cosmetics in Guangdong fight for courage, the spirit of the march forward and the determination to be the first. As financial writer Wu Xiaobo said, the post-50s and post-60s in their early years did not have any professional background. Many of them have not even graduated from middle school or primary school. The entrepreneurship of that generation should have three things: first, courage, second, diligence and third, good luck.

In the era of “Data-Driven products and media decentralization”, the new generation of entrepreneurs in Guangdong show different creativity and aesthetics.Huang Weiqiang, the founder of MAKE ESSENSE, was born in 1991 and Nick, the founder of AOEO, was born in 1997... They are indigenous people of PC Internet and a generation of globalization. Driven by them, the cosmetics industry in Guangdong is obviously accelerating and evolving in terms of production pace and product iteration.

Of course, in Guangdong cosmetics industry, there is no lack of people like Cheng Yingqi, the founder of blispring, and the brand operator with more than 25 years of experience “re-entrepreneurship”; There are also seasoned entrepreneurs like Xu Guofeng. In 2016, at the age of 81, he founded Guibeiwan Biotechnology Group Co., Ltd. to transform the cosmetics industry. His next goal is to “develop a new generation of biological beauty products and create high-end national brands belonging to Chinese people”.

Over the past 30 years, Guangdong industrial enterprises have been striving for self-improvement, showing tenacious and vigorous vitality. In recent years, they have been making difficult but fruitful explorations and innovations in building product brands, investing in technological research and development, and constructing marketing channels. Although the factors valued by entrepreneurs in the past are being reconsidered, diligence and innovation are still the ability and theme for Guangdong cosmetics enterprises to survive and develop.